LegitHyperbole said:

Exactly. Well said. That's why I think it's important to discuss this without saying they are out right nazis cause they obviously are not, you see the ones that get interviewed or just from videos and they are everyday working class people of all ages, in some videos it's teens doing the rioting which is usually the case for any riot. They are so obviously made up majourly of working class people who were misinformed by Far Right people. The demonisation is only going to make things worse, perhaps even have these people embrace the far right label. I've seen many independent interviews (and MSM ones too) where people at the protests all say they don't want to be called alt tight or far right. Holding signs saying they aren't far right but no-one listens since the media and Government has made reality once again, and now they are alt right thugs. |

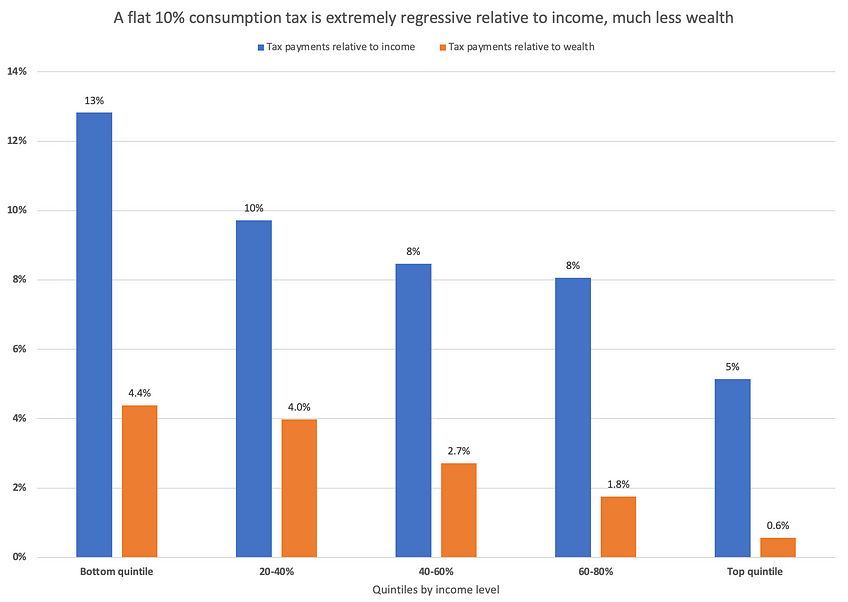

The French riots with the Yellow Vests were targeted the same way; the whole thing was blamed on the far right by some players. In reality, they were angry working-class people with a bone to pick, and their primary concerns revolved around hiking taxes on goods and fuel. Issues such as taxes and fuel pricing are usually met with anger from the opposition as well - citing environmental and social equality concerns first and foremost. The trouble in the case of the Yellow Vests was that the majority of them simply couldn't afford to care about the environment in such a way, and that very same tax that was supposed to lift them, became a heavy yoke instead. All of that was also down to a lack of nuanced discussion, in my layman's opinion.