sundin13 said:

Chrkeller said:

Tax the rich is always an interesting position. What is rich? From a selfish point, if I already pay more in taxes then most people make, why should I pay more? When I was fresh out of school money was super tight because I went without to ensure I saved at least 15% of my net. Now that I have investments people want to tax me more.

Not sure how any of that makes sense to me. But I suppose it is easier to spend other people's money.

I always have mixed feelings because I have more wealth than most, but I've always had smaller houses, cheaper cars, etc comparative to my peers... solution, tax me more?

I think, at least in the US, a consumption tax makes sense. 10% federal sales on all non food purchases.

Also I think getting rid of credits and deductions makes more sense than raising taxes.

Edit

I suppose my issue with raising taxes is the uber wealthy have a team of lawyers and accountants that will just loophole and defer owed payments. So raising taxes ends up on the back of high middle class and low high class. Simplify the tax code and get rid of loopholes.

And make Little Red Hen mandatory reading in secondary and at Uni.

Edit 2

The other issue, at least in the States, is the gap between the top 5%, 1% and 0.1%. Sure I am in the top 5% but I have a fraction of what the top 1% and the top 0.1% make more a month than I do a year.

I'm not calling anyone out in particular, but blanket statements calling for taxing the "rich" makes me wonder what is rich.

|

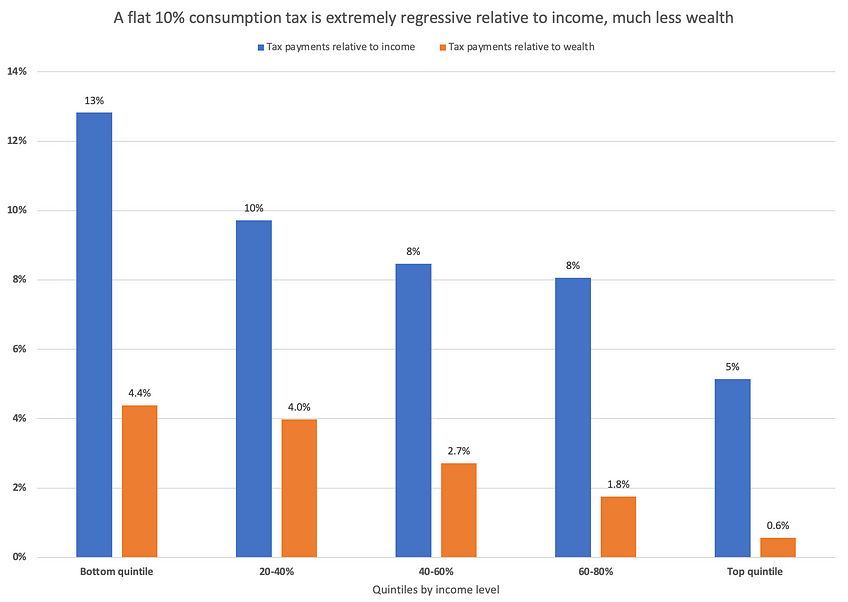

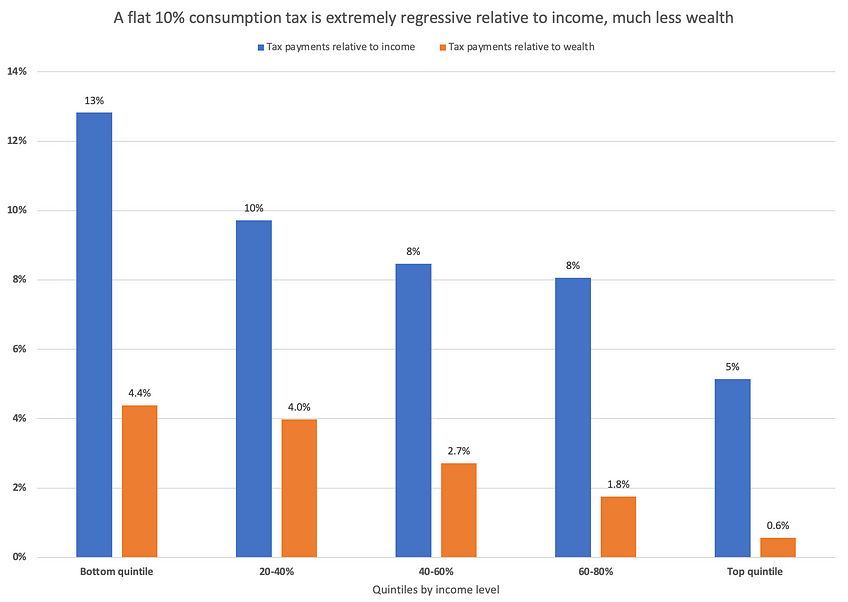

Consumption taxes are inherently regressive taxes. That means they fall more heavily on those who are poorer than those who are richer, because the poor spend a higher percentage of their income on goods than the rich. I support a more progressive tax system (aka one which falls more heavily on the rich) because it only makes sense to ask the ones who have a greater ability to provide assistance to provide that assistance. Your arguments surrounding simplifying the tax system aren't arguments against progressive taxes, they are arguments against bad tax code.

|

I'm well aware. In fact I've never once said a tiered system wasn't perfectly fine. I've only said fix the broken tax code before increasing taxes. Raising taxes in a broken system isn't going to help. The uber rich will still avoid taxes and upper middle class carries the cross.

And I've said food is out of scope for federal sales tax... it should be on luxury optional items.

So yeah, feels like you missed my point(s) completely.

And I'll note I've asked multiple times what is considered rich? Nobody seems to want to provide a numeric answer.

But yes, a tier system is wholly supported by me. I just don't want a tax increase before closing loopholes.

My percent tax, which is already higher than Trump, shouldn't be increased until a person like him actually pays what he is supposed to.