| Nik24 said: Great idea! However, I propose to include "entertainment" stocks in general such as lionsgate, netflix ec. |

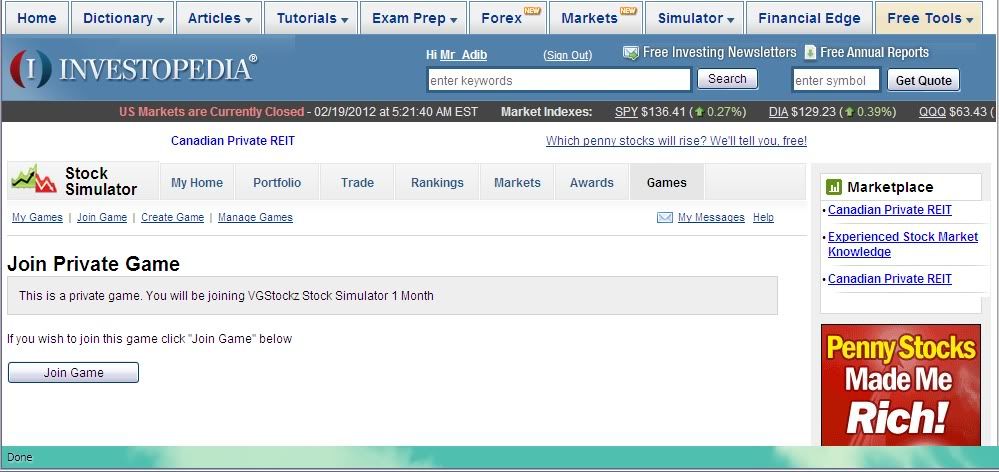

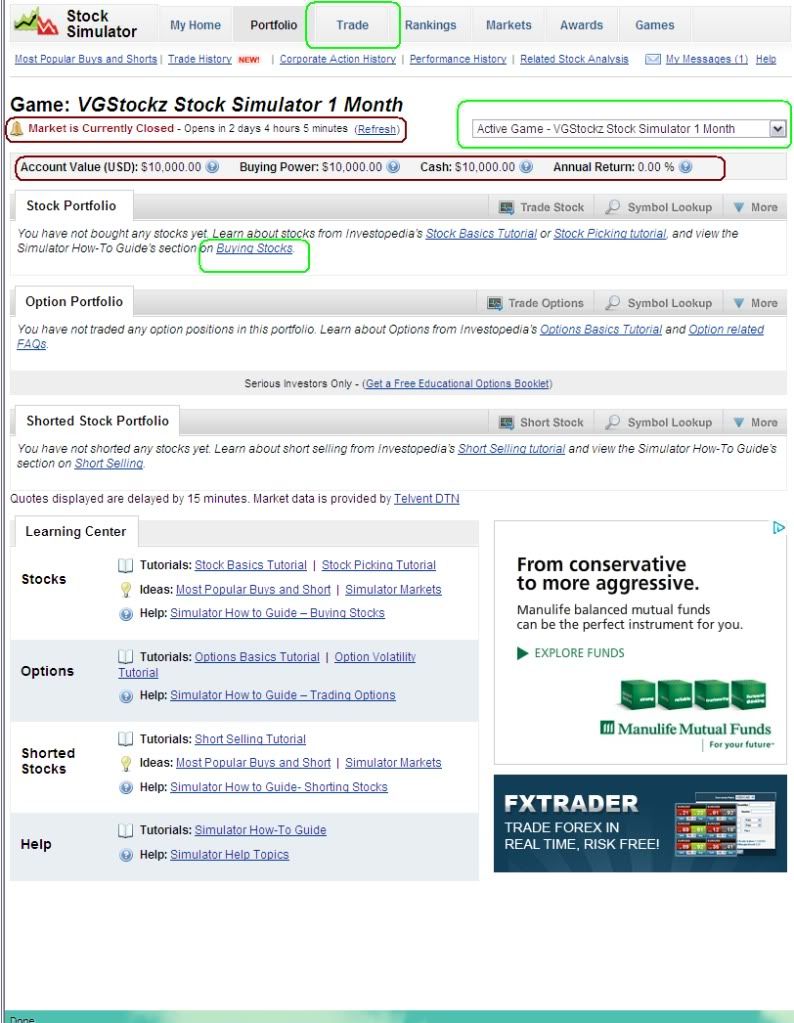

Thanks! We may want to add Netflix since most consoles now make heavy use of it. Though as much as possible we might want to stick to businesses that are deeply involves in games. Let's try to think of devs that are publicly owned that I may have missed. Is onlive public? I'll check. (edit: doesn't look like it. Couldn't find it on google finance) We could make a separate investopedia game for the movie industry, and a joined game for the entertainment industry. Let's start with gaming industry for the first game and expand from there ;) let me know if you guys joined so I can add you to the ladder board.

@ baalzamon. It's looking good for your school project! Was it limited to entertainment, or you could pick just any stock? Well, good job picking Nintendo. Though Nintendo's upswing seems bound to the upward jump of the japanese market, Nintendo stock does seem generally low and can really mostly go up. The fact that the next upward surge cycle is within a year and a half coming probably also helps. Smart move to pick a company in an industry you have your feet deep into!