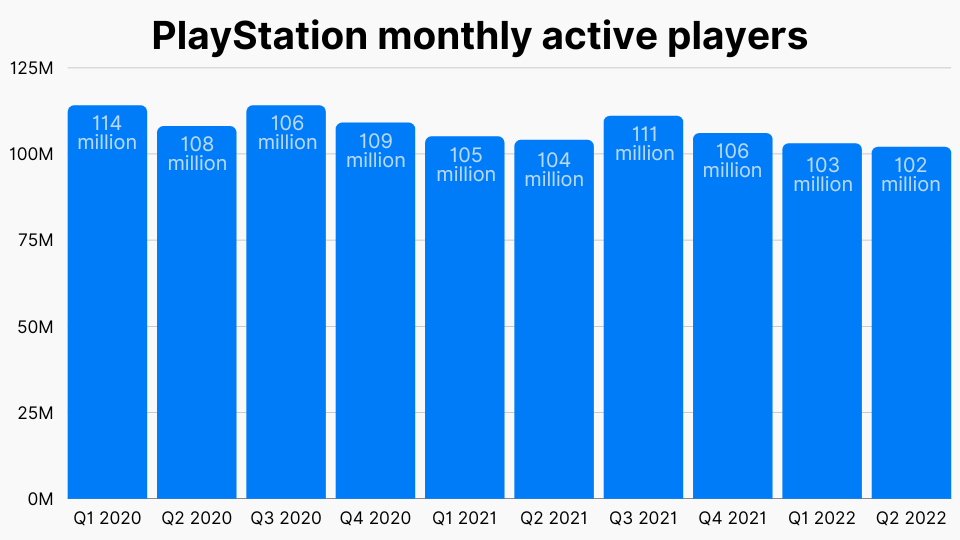

| EpicRandy said: You also saw a big ramp-up of studios being created since MS bought Bethesda. Those acquisitions are not what's cause consolidation, they happen because the time is propitious to investment in video game industries. The pandemic skyrocket the industry and now growth is through the roof and is expected to remain that way a least for a few years There were also significant periods of consolidation in the video game market both in the 1970s and the 1990s. Can you say gaming in the 80s and 2000s was worse because of it? |

I'd argue that its only propitious to invest in the gaming industry now because its the only industry left to be massively consolidated. That would mean Microsoft was the first to capitalize on this propitious time, and ultimately, the inception point of massive consolidation. Granted, you could argue that it was always going to happen regardless of what Microsoft did, but in reality they are the ones responsible for triggering the arms race.

Comparing consolidation back then to the present is not an apt comparison. The fact that two major platform holders have made some of their biggest transactions ever, as well as the many billion dollar acquisitions on top of that, significantly separates the level of M&A activity now compared to the 1970's or 1990's, making any comparison or discussion about market impact null and void.