Ryuu96 said:

"Job growth totalled 73,000 for the month, above the June total of 14,000 but below even the meagre Dow Jones estimate for a gain of 100,000. June and May totals were revised sharply lower, down by a combined 258,000 from previously announced levels. At the same time, the unemployment rate rose to 4.2%, in line with the forecast." - June was revised down from 147,000 to 14,000.

- May was revised down from 144,000 to 19,000.

But the stock market! Disaster numbers, Lol. |

These numbers kind of blew my mind, but it definitely puts Powell in a tough spot. With inflation ticking up again, Powell has had a pretty easy decision when it came to holding rates steady because the job market has looked strong. Now the numbers are showing huge red flags in the job market.

Does he cut rates and risk inviting another inflation spike or does he hold steady and risk watching the bottom fall out on the jobs market?

Just three days ago the Fed decided to hold rates steady saying this:

"The unemployment rate remains low, and labor market conditions remain solid. Inflation remains somewhat elevated."

I don't know if they would have said labor market conditions remain solid if this was released after those revisions came out. With the next meeting in mid September, all eyes will be on the next Employment Situation release. If the pattern of downward revisions continues, a rate cut seems likely.

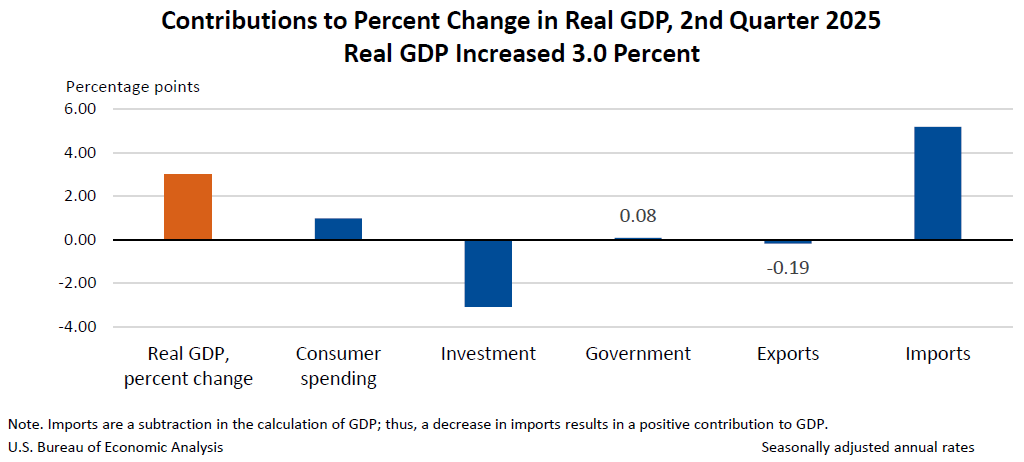

In other economy related news, preliminary Q2 GDP estimates came in at 3%. Now, in a vacuum, 3% is pretty good. The issue is that this was supposed to be a bounce back quarter. First quarter got hammered by imports trying to beat the tariff craze, so second quarter was supposed to rubber band due to a decline in imports. That did happen, yet the number was still only 3%? What is going on:

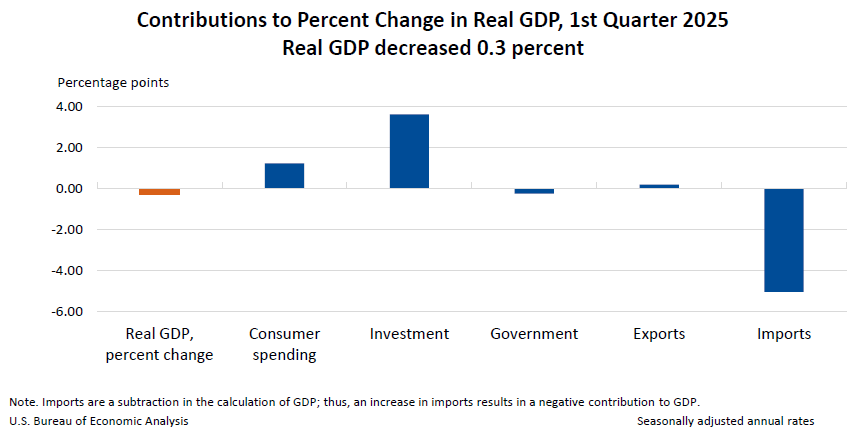

Well, pretty much all the other data is bad. For comparison, here is the advance estimate for Q1 (updated numbers that I found didn't include this breakdown):

Q1 was destroyed by Imports, cutting 5% from GDP, but strong investment did a lot of work stabilizing that decline. Q2 saw decreased imports buoying GDP but Investment really fell off. Unless investment ticks back up again, once imports stabilize after burning that Q1 inventory, GDP numbers could get pretty ugly pretty quickly...

The economy seems to be flashing a lot of warning lights right about now