Kasz216 said:

That's an extremely deceptive or very stupid way to use the data.

The recession's happened when it was at it's highest NOT because it was at it's highest, but because when wealth is destroyed it usually is disproportionately destroyed at the top. You've got your causation wrong. It's not the highness that causes the crash. It's that the crash causes the number to shrink aftewords!

Additionally, you're using decades long data and ignore the more local trends.

Instead I would suggest looking within decades which is a much better way to look at the data as it cuts back on extranious values. (Like say, huge industrial revolution, being the sole economic super power.....)

|

You're viewing the wrong part of it. That it went downwards after the recession/depression hit isn't the important part. The important part is where it was climbing rapidly prior to it. If you look at the minor recessions, you'll see that they typically occurred when there was no rapid climbing prior to it. It was the big ones that involved dramatic peaks.

And looking "within decades" doesn't make sense, because the rules don't typically change much within a decade, except for the big changes that occur on the broader view.

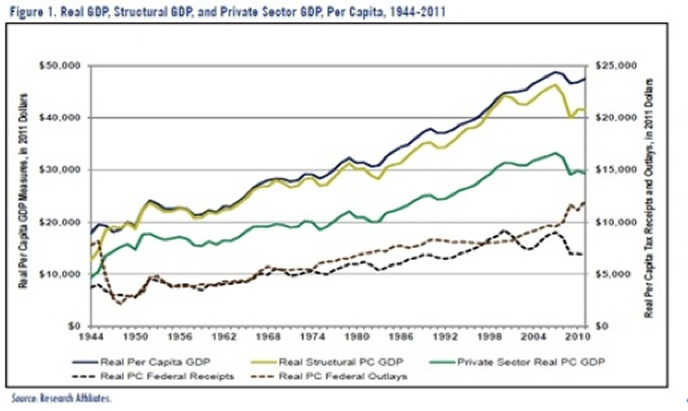

But if you insist, let's look at what happened in the 2000s. Tax cuts for the rich (and yes, everyone else) weakened the economy. Mind you, they caused short term boosts, without a doubt. But the end result was a weakening. Look just at the 2000s in the per capita GDP graph. Specifically, look at the downturn that happened. You can't blame it on the housing bubble, or anything like that, because the downturn started earlier than the GFC and related issues.

Meanwhile, which graph are YOU looking at? I look at the GDP per capita graph, and see an acceleration beginning in the early 1960s (when the tax rate was very high) and then only a momentary variation in 1968 and 1969, likely the driving force for the tax rate changes. More importantly, I look at what happened starting in 2001 - and what I see is an exponential growth pattern up to 2000, and then a sudden flattening in 2001, followed by a slower growth pattern that accelerated until around 2005, at which point it downturned, and by 2007 it had a negative slope. How the hell can you interpret that as supporting the idea that tax cuts drive GDP higher? And no, 2005 was not the start of a financial crisis. That was 2007, when the housing bubble peaked. The economy was already downturning by then.

Let's make this easier using a graph showing CHANGE in GDP per capita by year.

So, let's look at these relative to tax rate. Starting with 1950, there's four solid years of growth of over 2%. So what happened in 1950? Tax increase.

What happened in 1954, though? Tax decreased a bit. Presumably, not a significant effect, though, so let's move on, and ignore it. The next significant event in terms of tax was in 1964-1966 - no significant effect for those three years on GDP. Then in 1967 GDP growth dropped. In 1968-1969, taxes were increased, and GDP returned to stronger growth. Then in 1970, taxes were cut again, and GDP change went negative again.

Taxes stabilised after that, so we now jump forward to 1982, when there was a significant cut in tax. In 1982, GDP change was more negative than any time since 1947. Then the next tax cut came in 1987 - year of the lowest GDP growth between 1983 and 1989, although admittedly only a small drop. In 1991, there was a tax increase that did tie with a GDP drop - the first one we've seen so far. In 1993, tax was increased again, more significantly, and didn't make much difference.

Finally, the tax was reduced in 2001, 2002, and 2003. In 2001, GDP growth dropped to nearly zero, and despite two more cuts, growth remained slower than prior to 2001.

So to tally the results, we find that drops on tax increases = 1. Drops on tax cuts = 3. Now, using the total GDP per capita graph, we look at average growth rate during the period in which the top tax rate was greater than 65% - that is, 1936 to 1981. GDP per capita in 1936 was roughly $9000. In 1981, it was about $29,500. That's an average growth rate of $456 per annum. Between 1982 and 2010, the tax rate was never above about 50%. In 1982 it was about $28,500 (rounding down) and in 2010 it was about $48,000 (rounding up). Average growth rate was $696 per annum. Which makes the latter case sound better, until you remember that this isn't scaled to current GDP - that is, we're looking at the absolute number, rather than the percentage increase.

So let's look at the percentage increase. We'll look at it three ways - relative to starting GDP, relative to average GDP, and relative to finishing GDP. So, the three percentages (per annum) for the high-tax period were 5.067%, 2.369%, and 1.546%. For the low-tax period, they were 2.442%, 1.82%, and 1.45%. So no matter which scaling you choose, the high-tax period came out ahead.

A better demonstration would be made by doing a 5-year running average, to smooth out short-term fluctuations, and view the net effect.

Evidence is rather strong - economy may take a small hit on tax increases in the short term, but it improves the economy in the longer term. Tax cuts, on the other hand, often causes a stronger hit to the economy in the short term, and less impact in the longer term.

But remember, we're looking at all of this in isolation. If one were to look deeper, you'd find that it's not the tax cuts or increases that are affecting the economic conditions. It's actually government activity. When government cuts spending (which is necessary when cutting taxes), it weakens the economy. Increased government taxation allows better spending, which drives the economy.

It should be noted, though, that the current tax systems in both Australia and America have a major flaw - it actually encourages the rich to get richer and to not invest in reasonable ways. And this was still true when taxes were absurdly high for non-extreme cases. My idea is to have taxes simplified in terms of numbers (simple steps of 10%, starting at 0% and finishing at 90%), but having the point at which each tax rate kicks in be varied automatically based on the distribution of income. And then, investment would simply subtract from the taxable income, but divestment would then add back to the income in the year that it happens.

For instance, a simple example that I've come up with works off a simple 50% basis, and it works like this: consider the total income of the entire population; let's say that it's $1 trillion, as an example number. Then you find the income value, X1, such that, if you add all of the incomes of people who earn less than X1, and then X1 of the incomes for the rest of the population (so if X1 = $10,000, and you earn $5000, then it adds your whole $5000, but if you earn $15,000, then it adds just $10,000), the total is $500 billion. That is, 50% of the total income. Those who earn X1 or less pay 0% tax, and those who earn more than X1 pay no tax on the first X1 of their income.

Then, 10% tax is charged on incomes between X1 and X2, where X2 has a similar property - add up all incomes up to X2, and it should work out to 75% of the total income, or $750 billion (so 25% is between X1 and X2). It works the same way for X3, X4,... X9, each time adding 50% of what remains. All incomes above X9 are taxed at 90%. I would also considering having it work on household rather than individual incomes, with certain conditions (such as each household representing some number of people - for instance, maybe additional adults are valued at 0.5 and children are valued at 0.3, so that a household with two adults and two children would be taxed as 2.1 people - those numbers are just examples, of course)

With this system (assuming no economic growth or shrinkage), it works out that the government would end up with about 10% of the total national income. If it worked off 33.333% rather than 50%, then it would end up with about 18.3% of the total national income, whereas if it worked off 60%, it would end up with about 6.68% of the total national income.

The cutoff points would, for the sake of keeping things from being difficult to manage, be set to the values from the previous year. What this means is that, if the economy grows, government gets more total in tax, but if it shrinks, the government gets less. If the economy remains steady, then it doesn't matter what the income distribution itself is, the government ends up with exactly the same amount of tax income. Note that I would duplicate this system for corporate taxes (although the scales may not be identical) - this would actually have the effect of discouraging the formation of huge megacorporations, as such megacorporations would be taxed much harder than smaller companies. Also note that the tax system would be local-based - that is, in order to do business in the country, you would have to have an in-country company branch, which would be taxed based on national income and national expenditure, and thus offshoring would actually harm the company in terms of tax (due to increasing national income but decreasing national expenditure).

What such a tax system would do is it would encourage greater investment by the rich, while giving the government stronger encouragement to grow the economy. It would also encourage companies to pay more to employees, and to do so in a more equal manner. I should also note that I'd abolish most of the other existing taxes (including "Social Security tax" in the US, for instance), and tax "credits" would be very stringently set up, purely as support where absolutely necessary. Note, though, that in the US, this system would reduce taxes on the poor to 0% immediately. Most notably, I'd abolish sales taxes entirely, except perhaps a "luxury tax", but that would be very limited if used at all. Income and Corporate taxes would have a similar effect, anyway.

I know it's a bit hard to follow all of that - it's hard to explain without detailed images that I can't be bothered creating. Think of it as being like a tax system that uses a "water level" effect - up to each water level, you pay a certain amount of tax, and the water levels are defined by national income.

Right now, on the other hand, governments can screw with the numbers without most of the population noticing. For instance, they can increase taxes on nearly everyone without changing the percentages even slightly. All it takes is changing the thresholds - in 2012, for singles, you pay 10% on the first $8700. If you change that $8700 to $7700, then everyone earning more than $8700 ends up paying an extra $50 in tax (and between $7700 and $8700, they pay somewhere between $0 and $50 extra, depending on the exact amount), despite the tax rates themselves not changing.

I'm aware that it sounds complicated... but it's actually no more complicated for the regular person than the current system - indeed, it's simpler for most people, since those not earning massive amounts would just need to look at a table and compare with their income. The table would say, for instance, "Those over X2 but below X3 pay Y2 + 20% tax on all income over X2", where X2, X3, and Y2 would be specific values. It's exactly how the current system works, with regards to income tax tables.

... OK, that's more than enough for now, I guess. Sorry if I bored anyone.