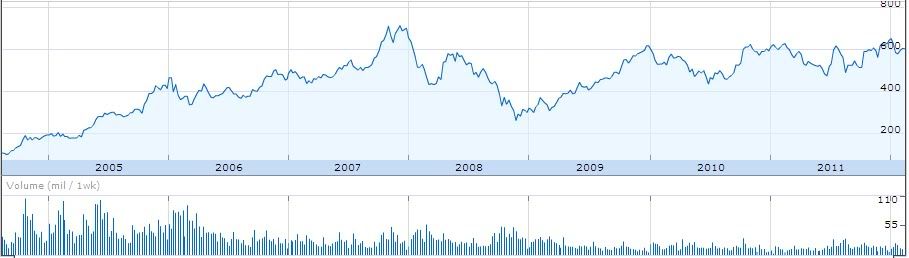

Well right now I hold TTWO and EA.

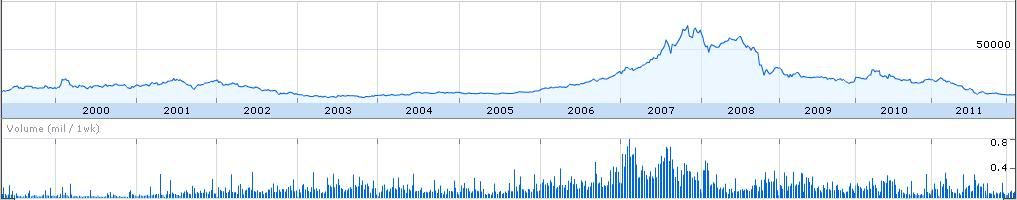

I've been holding TTWO for now a year and my position is up 21%.

I'm not planning to keep it forever however as the stock fluctuates too much depending on GTA releases.

Right now my goal is to unload probably around the time that GTA releases as the stock always spikes around that time too.

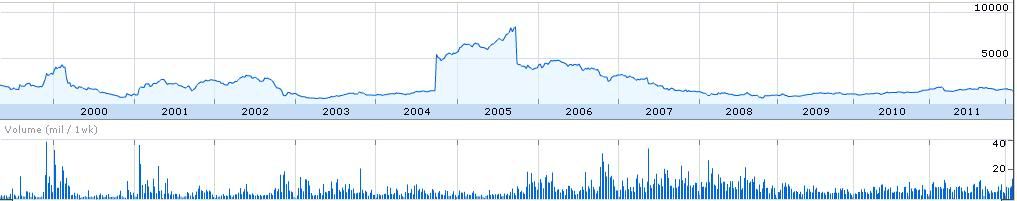

I hold a small EA position too, bought it when the stock fell in early january on bad SWTOR rumors.

So far I am down 1.5%. I'm planning to wait and see on that one, I think the stock can get up back to around 22$ easily, just not sure of which time frame...

I don't own any Nintedo. The stock is cheap but I'm not sure it has much upside as I haven't bought into the Wii U success yet. Furthermore I predict a very bad Wii decline this year and I'm not sure 3DS will even be able to offset that decline. Finally I have very little faith in Nintendo's executive track record as the company has missed every prediction they made these last 3 years so I'm not sure why I should believe what they say ( fool me once, shame on you, fool me twice, shame on me).

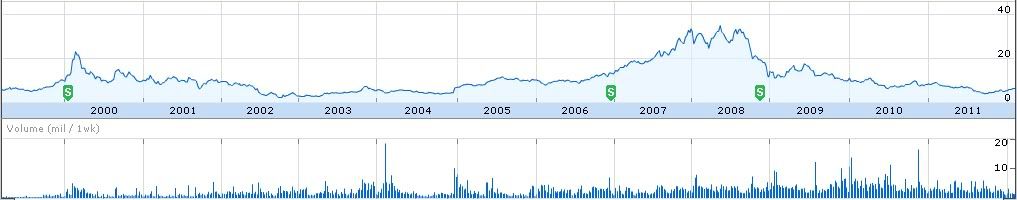

I was going to get into Sony back in January when the stock dropped back to 17$ but I didn't have any liquidity at that time and now the stock is up to 20.5$ so I missed the rally...That would have been a short term move anyway, I don't think Sony's financials are going to be improve that quickly but the stock was dirt cheap and I know it was bound to rebound, I didn't expect it to be that fast though...

I woudn't touch THQ with a 10 foot pole. ( i don't trade sub 1$ stocks).

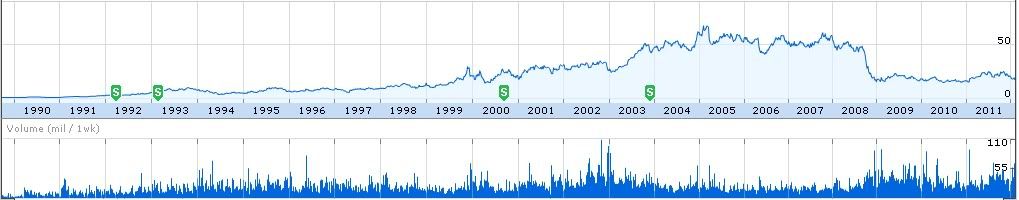

ATVI is a solid stock but I don't think it has that much upside so I am staying out of that too ( the company is very well managed but I don't see how they are going to keep fueling the growth..)

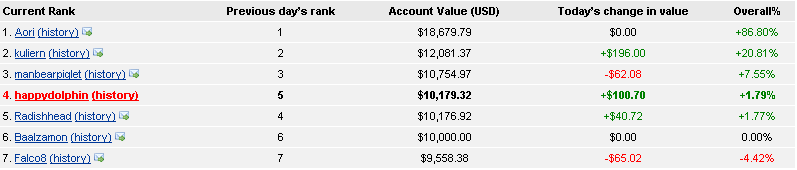

To be honest my positions in TTWo and EA combined represent only a little less than 5% of my total holding so I'm not that heavy on video games companies....

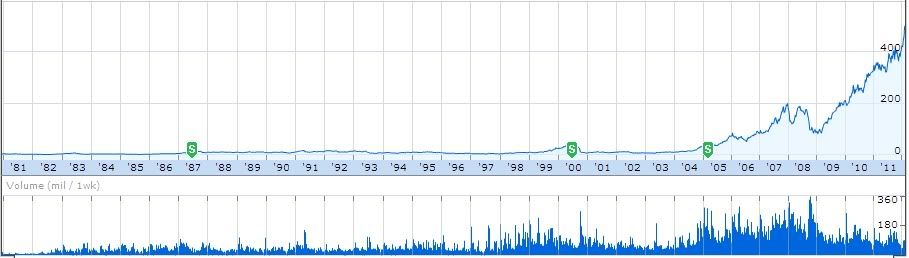

My heaviest individual holdings are by far AAPPL ( 15%), GOOG ( 11%) and NVDIA ( 7%)... They are all heavilly up since I purchased ( 15% to 26%).

And yeah i can't stand Apple and love Amazon but I can't buy stock my heart. From a stock point of view, Apple is cheap and Amazon is too pricy...

I might have some indirect expostions to others video games companies as I hold a software and computer mutual fund...

Right now I have some liquidity coming up soon so I am going to buy more stocks but I don't think it will be into video gaming except maybe add some to my EA position as right now I feel EA is the only cheap video gaming stock.. So I need some new ideas ( I've been looking at AKAMAi and QUALCOMM but not sure, I did open a 5% position on GE as I like their dividend and the stock is still relatively cheap..)

I forgot to mention MSFT, I don't own any position and I'm kicking myself for missing the recent 30% rally but the stock has been flat for so long who could have guessed .... Still I understand why it happened, Microsoft offers a healthy dividend and they have a lot of room to increase it and with the current low in bonds interests a lot of investors are looking at dividends stocks..