mrstickball said:

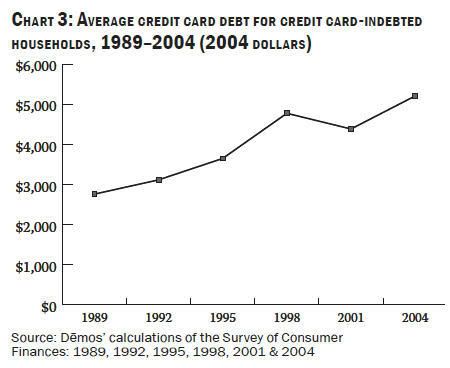

The truth is, ANYONE in America can become incredibly wealthy if they wanted to. Unfortunately, our culture is obssessed with activities that create more debt than wealth: Massive college loans, big fancy cars and houses, and massive entertainment spending. When my fiancee (now wife) and I were both working for minimum wage, we accumulated huge amounts of capital and wealth simply because we saved what we could. Although things aren't perfect (I have stupidly accumulated some debts), we are much better off than those around us, who racked up significant debts for things that never lasted.

|

There is also the reality that ANYONE can also make a bunch of money in a casino to, but most won't. That is NOT because of what people do, but because of luck. And to deny luck doesn't play a factor in someone getting incredibly wealthy, is to deny reality. The fact is, to get massive wealth, you have to take a good number of risks that pay off. Before anyone just pass this over, you need to know what risk is. Risk is the chance to get a payoff or lose. When you lose, you fall further behind. You get early in on a bubble of demand, and then get out early enough, you will end up wealthy. But, you don't see the bubble, guess wrong, and so on, and blammo you are out of luck. According to some financial planner person I ran into when I worked at IBM, I was supposed to become a millionaire when I retired, if I just followed his advice and kept getting 7% annual pay raises that IBM was supposed to give out. Well, nope, that didn't happen. In my case, I lost my job with IBM, and ended up blowing out my 401K borrowing it for a high risk business venture. That was then followed with bankruptcy. Maybe I do make it someday with what I am working on now. But, anyone here think it is because of some genius I did, or just things came together because I was lucky? Ok, maybe God will bless me here, so it won't be luck, but I believe it is folly to believe there is some magic formula you can do that will guarantee you make it.

All this being said, it would be beneficial for everyone to live below their means, and acquire assets that generate income when one isn't working. This is why the rich do get richer. It is what people need to do, and if you can acquire enough assets to cover your expenses, you become independently wealth, and can retire. And no, the American culture doesn't tell people how to get financially independent. It teaches people how to live a middle class existence, which is increasingly becoming unsustainable at this point, and does require more be done. People need to learn how to go from being consumers to creators who produce things of value that make a difference in the world. It starts by turning off the TV and working to refine skills that people want, and that can then be leveraged using things like the internet. It requires also mastering being content, so you don't go distrated by doodads that do nothing to increase wealth, but also be able to be focused on performing and getting better at this, and wanting more, based on a solid foundation. No guarantees here, but you stand a FAR better chance of getting a head if you do this, rather than get sucked into the consumer land of evermore. The American economy is built on it, and one has to wonder how sustainable it is.