rocketpig said:

The wealthiest 5% of Americans were much closer to the middle class in the 50s and 60s. The wealthiest 5% were also taxed much more heavily in the 50s and 60s. Inflation doesn't explain that away. Minimum wages are not keeping pace, family incomes are not keeping pace, nothing is keeping pace with inflation... except the wealthiest of the wealthy, who are surpassing it. Saying that the government's deficit is at fault for that doesn't make sense. |

Ah, but I don't think that minimum wages are the root of the problem.

For America, I think one of our major problems is personal debt. Americans have a horrible lust for debt, in the pursuit of more material goods.

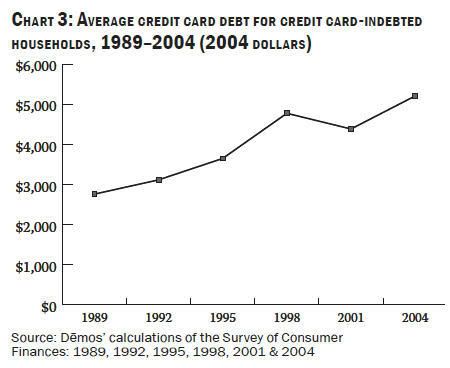

That is in inflation-adjusted dollars. In just 15 years, credit card debt has risen almost 100% in inflation-adjusted dollars. At a 19.9% APR, that is absolutely huge in becoming a drain on wealth-creation for the poor and middle class. Think about what wealth is: assets without liabilities (use any term you like, but that is the basis of having it). If that statement is true, then poverty is liabilities without assets. Given what our credit-driven consumerist culture buys with its credit card debt: toys, games, food, movies...Things that depreciate or have very little long-term worth, then you understand that it becomes a major impetus to wealth.

The truth is, ANYONE in America can become incredibly wealthy if they wanted to. Unfortunately, our culture is obssessed with activities that create more debt than wealth: Massive college loans, big fancy cars and houses, and massive entertainment spending. When my fiancee (now wife) and I were both working for minimum wage, we accumulated huge amounts of capital and wealth simply because we saved what we could. Although things aren't perfect (I have stupidly accumulated some debts), we are much better off than those around us, who racked up significant debts for things that never lasted.

In the end, the road to wealth or poverty becomes a feedback loop: If your somewhat better off, you likely have a lower debt-to-income ratio. As long as the money is managed decently, it continues to accrue, which allows one to become very, very wealthy over the course of a few decades. Likewise, if you continue to live in excess, and accrue a higher debt-to-income ratio, you will never become wealthy, as what would become wealth, is instead given to pay debt on goods that you no longer own (such as spending money on a PC which depreciates to $0 over 6-7 years).

Back from the dead, I'm afraid.