mrstickball said:

Akvod said:

mrstickball said:

Akvod said:

So are you saying that this recession was caused due to boredom? What has SIGNIFICANTLY changed before the housing bubble burst and credit crisis?

Nothing.

Perhaps people are simply feeling that they have a low permanent income, and that their wealth decreased due to the housing bubble burst and stock crash? And are spending less?

You're fucking claiming, that the reason why there's such low demand is simply because there's nothing people want. Bull shit. Fucking BULLSHIT. Boredom did not cause one of the biggest recessions. We've had so much innovation these past few years, technology has been increasing at an expotential rate. FUCKING BULLSHIT.

|

Way to really take what I say and warp it into your own way. Your very mature when you start cursing like a sailor, exclaiming I'm saying things when I am not.

My argument about production is that in some cases, new technology will antiquate certain business practices, and its up to entrepreneours to create new jobs and businesses to create new jobs for people. We're not quite having that due to the incredible amount of red tape in America that is preventing a recovery as fast or as wide as we'd want it.

Having said this, I was merely talking about production and consumption in general, not about the recession. Way to go (yet again) putting words in my mouth, and flying off the handle.

If your wanting to ask why I believe the recession happened, I take after the stance of Peter Schiff. I'd suggest reading up on him (if you haven't) as to why the recession happened.

|

Yes, but that's why I asked you, what has SIGNIFICANTLY changed? You make it sound like companies just dumped a bunch of jobs because they became super duper efficient due to some alien technology. I don't care about the long term RIGHT NOW. This is what's making me fucking feel like there's a tumor in my balls. Why, of all the times we could have done it and we can do it later, do we have to tackle the debt issue NOW? Why are we talking about trade imbalances RIGHT NOW. That's why, in the very beginning of this thread I posted the article: Spend NOW, save LATER.

And this thread IS about the recession. Why did you decide to just talk about "innovation" if you weren't meaning it in the context of the recession? That's just so fucking random man.

And don't tell me to read up on Peter Schiff. I post specific articles from Paul Krugman that relates to the topic at hand instead of telling you to read all of his writings.

|

Nothing significantly changed at once. It's been a progression of the past 20 years. The reason it changed all of a sudden is that demand was over-saturated. Rad up on Peter Schiff. He predicted the recession well before your bud Krugman even thought there'd be an issue on the horizon.

Do you have to keep cursing so much? Its really not making you look any more mature. Your arguing like a 15 year old that thinks he has a master's degree in economics. My argument was based on the run-up to the recession. I was trying to argue both in the recession and outside of it. Again, look into Schiff as to why I believe what I do in regards to the lack of innovation and bad regulations coupled with inflated consumerism as to why we've had the recession, and why there has been no real recovery from it.

Peter Schiff's synopsis is that due to rampant consumerism during the 90s and 2000s, prices rose (especially in the housing market) rose to inordinate heights due to bad practices by businesses and government. The reason we have horribad unemployment is that consumer spending is back to where it should be, and there hasn't been enough job creation to get the jobs back.

Again, if you don't want to read up on others that aren't Krugman, then your really going to miss out on a well-rounded economic viewpoint. Schiff is a good place to start, because his synopsis is about an hour long, and easy to understand. I've read Krugman many times. I still read each article he posts. Most of them I disagree with, but I still read him to understand his viewpoint....Yet you argue against learning about someone, simply because his name isn't Krugman.

|

Inflation itself DOES NOT MATTER. It's the inflation RATE that matters. It doesn't matter if prices have increased, as long as it has increased at a steady rate. If you're going to talk about wages not increasing with the price of good, sure, but again, you're pointing out long term problems we have, but never identifying why exactly it all "just melted down".

But this is my point, while there were a lot of major things happening specifically concerning credit, technically the great majority of Americans had the same income. The majority of Americans still had their jobs. Right as soon as the news hit on the TV.

So Keynesians believe that people, seeing their fucking savings just dissapear due to douche bags and their houses become worthless, and hearing that the economy will go down the drain, BEGIN TO SAVE.

http://en.wikipedia.org/wiki/Wealth_effect

http://en.wikipedia.org/wiki/Permanent_income_hypothesis

And this is the part I hate. You made claims like "Keynesianism was disproved", and give me these arguments that do not use data, is not taught in academia, etc. You sound like some religious person saying "He predicted this". I care more about the RATIONALE behind those predictions. And that rationale is crap.

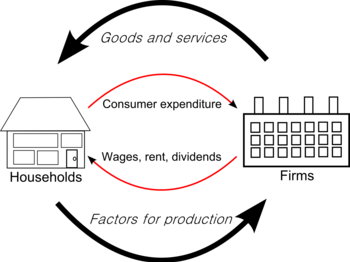

Because the wealth we had was NOT an illusion. The is the stupidity of the 30's. We thought that we had to "cut back" or that we had to "flush out the inefficiencies". Yes, both in the 30's we had a bubble and over valuation. But if you're saying that bubble was equivallent to the loss in production and consumption we're having now, I really cannot listen. We have been able to physically create Goods and Services a few years ago. We have the capability, we have the resources, etc. The only thing that's different, is in the mind. People don't want to buy anything anymore. If people don't buy anything, then firms don't make things. If firms don't make things, then firms don't need workers.