RolStoppable said:

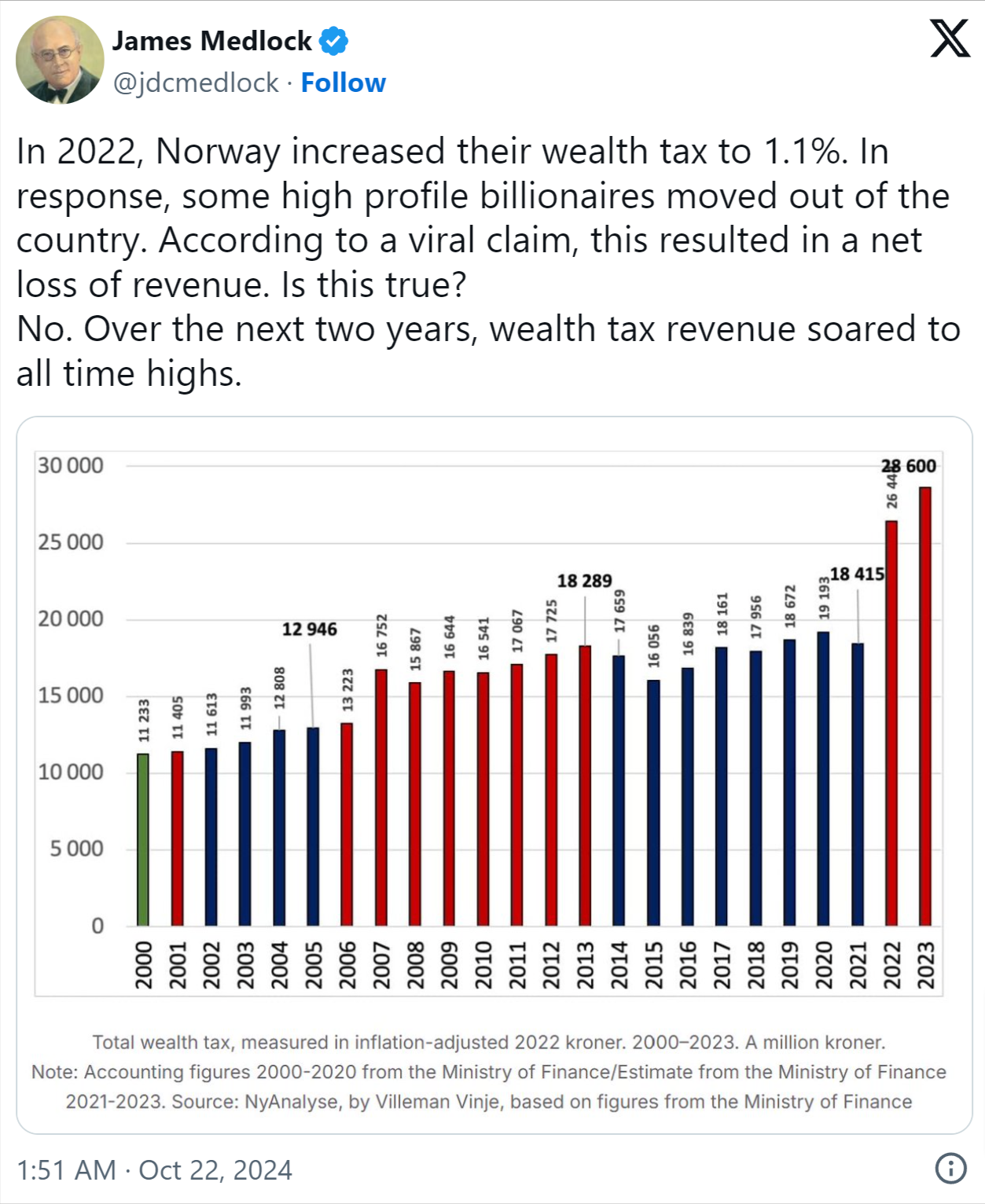

Obviously, the implementation of a wealth tax must include measures to prevent tax evasion. Pretty much like every other tax. Other than that, it's awfully convenient for the rich that raising the taxes on them is a bad thing because supposedly it will hurt everyone else much more. But what do the facts say? We have an actual example in Norway:

So despite the existence of some tax refugees, the result is positive overall. Norway's wealth tax was increased from 0.85% to 1.1%. So a little change like that increased tax revenue by ~50%. The wealth tax revenue in 2023 converts to €2.4 billion which is quite a hefty sum for a country like Norway where only ~5.5 million people live in total. People who possess less than €150,000 do not pay this tax while rich people remain rich, and the country of Norway has one additional billion Euro to spend every year. |

Well, I think I said already, that taxing the rich results to a taxing everyone else. Taxing fortunes above 150k is taxing the middle class while the rich leave, just as I pointed out. Keep in mind that Norway is expensive and it has high taxes already, so there isn't many people who actually could leave in the first place. You tax the property of the middle class who can't leave as tax refugees. The country has billion more to spend but the people have a billion less.

Did Norway win or lose with the total taxes collected?

Ei Kiinasti.

Eikä Japanisti.

Vaan pannaan jalalla koreasti.

Nintendo games sell only on Nintendo system.