| bdbdbd said: The high management raises their salaries. Also the owners would want more money out from the company because they want the same income as they did before. The whole idea of "taxing the rich" is based on them getting more money out of the companies so nobody would not lose anything. If the overpaid board members are incredibly bad PR, shouldn't the taxes be lower so that they'd not need to pay the board members as much? A wealth tax of 1% may lead to more capital leaving the country than it would bring in as tax revenue. Taxes for the rich always lead to taxes for everyone else. The reason why these taxes work so bad in todays world is because of globalism and global free trade. Capital goes from one country to another without being taxed in between, so does goods. |

Obviously, the implementation of a wealth tax must include measures to prevent tax evasion. Pretty much like every other tax.

Other than that, it's awfully convenient for the rich that raising the taxes on them is a bad thing because supposedly it will hurt everyone else much more.

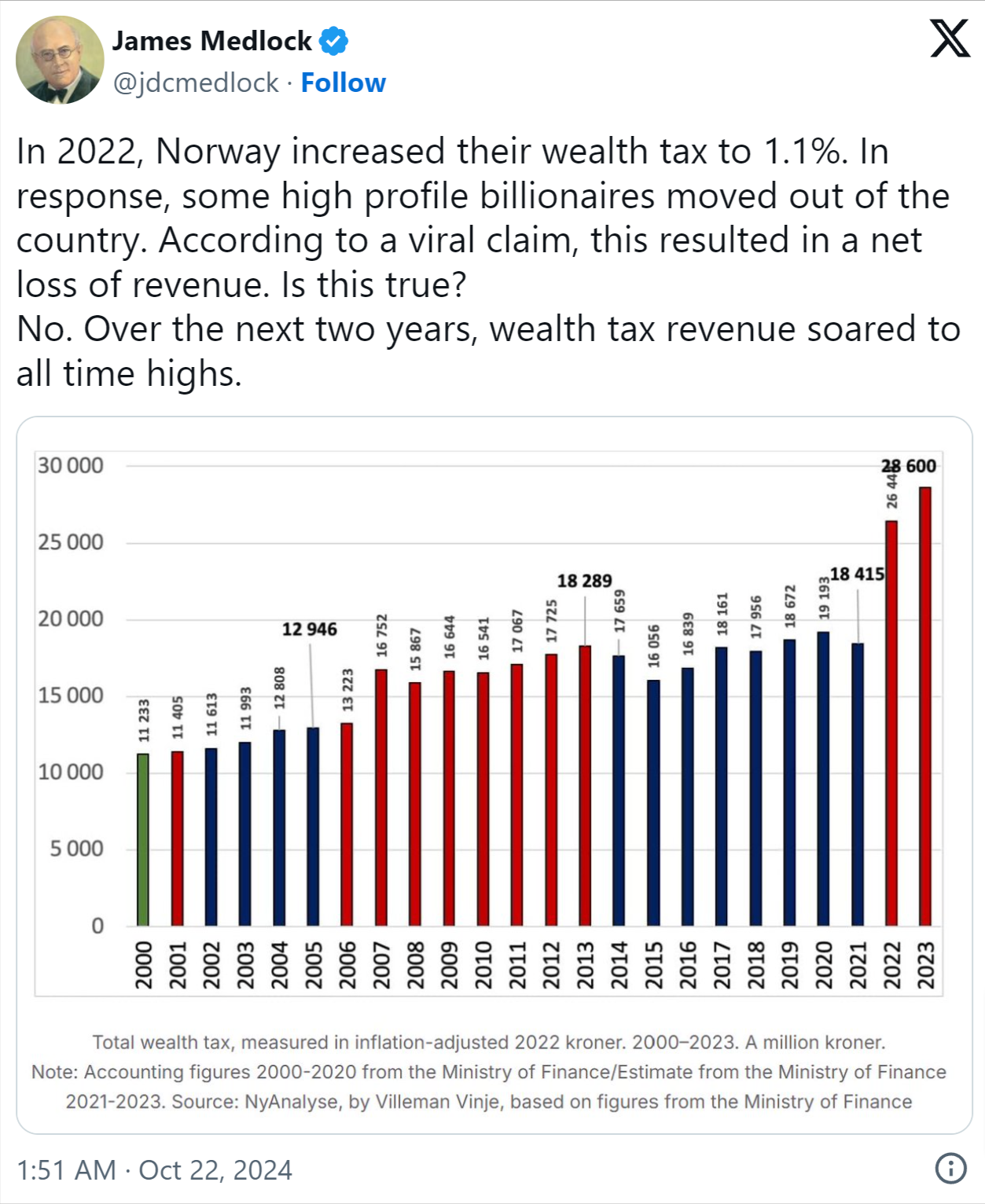

But what do the facts say? We have an actual example in Norway:

So despite the existence of some tax refugees, the result is positive overall. Norway's wealth tax was increased from 0.85% to 1.1%. So a little change like that increased tax revenue by ~50%. The wealth tax revenue in 2023 converts to €2.4 billion which is quite a hefty sum for a country like Norway where only ~5.5 million people live in total. People who possess less than €150,000 do not pay this tax while rich people remain rich, and the country of Norway has one additional billion Euro to spend every year.

Legend11 correctly predicted that GTA IV will outsell Super Smash Bros. Brawl. I was wrong.