crissindahouse said:

Euphoria14 said:

|

crissindahouse said:

thx man! i wonder why they don't control the online purchases better? it has to hurt the shops who don't sell online (and produce more jobs) doesn't it?

i know from here that retailers in the cities have problems to stay alive because of the online shops but the tax is the same for both. if i could get it over the internet tax free (ok you say you should pay tax then as well but nobody does^^) or would have to pay tax in the shop the price difference has to be even greater!

but great that your tax rate is between 4-9% in most places in usa, we have 19% here for most products :( ok "only" 7% for groceries but for almost everything else 19%. it'S the most important tax for our gouvernment. more than 30% of the tax income comes from this.

i wonder how much would be the difference between the costs for a german or an us american with average income with all taxes included. tax on income, tax for gasoline (which is a huge difference between usa and europe and especially germany), and so on...

|

Just out of curiousity, how much does your income check get taxed? I know that here in New York, after medical, dental, social security, NY State Tax, Federal Tax, etc... I lose anywhere between 25-30% of my check. Then on top of that I have to pay 8.65% tax or so on just about every purchase I make...

It sucks here too, especially on Long Island where the cost of living is high.

|

hard to say. depends if you are single, married and both work or only one of both, if you have children, how much your income is and blabla^^

first 8k per year are free and people above that have to pay between 14-45 percent. and on top of that you have to pay 5.5% of the income tax as "solidarity" payment for eastern germany (old ddr) to get this area to the same standard western germany has. and then you have to pay a little bit if you are "officially" religious :)

but an example:

let's say you are single and earn 30k euro per year "net" (after payment for health insurance, pension insurance and so on), then you have to pay 31,5 percent income tax + 5.5% solidarity payment of the income tax amount.

if you earn 40k it's 36.1 percent and if you only earn 20k it's 27%.

if you are married and only one spouse is working and you have some children it can be much better for you.

|

Sounds confusing.

So, if you were to make 32k euro per year gross, what would be your take home pay for that year?

Here in New York if I were to make (Let's pick a random number shall we? ) ~$32,760/year gross, after paying for taxes, medical coverage and all else as a father of (1), you would bring home just ~$21,251.

iPhone = Great gaming device. Don't agree? Who cares, because you're wrong.

Currently playing:

Final Fantasy VI (iOS), Final Fantasy: Record Keeper (iOS) & Dragon Quest V (iOS)

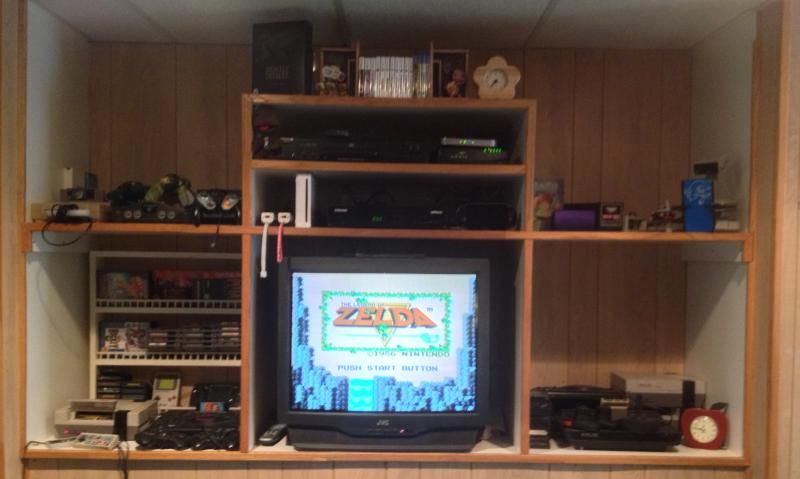

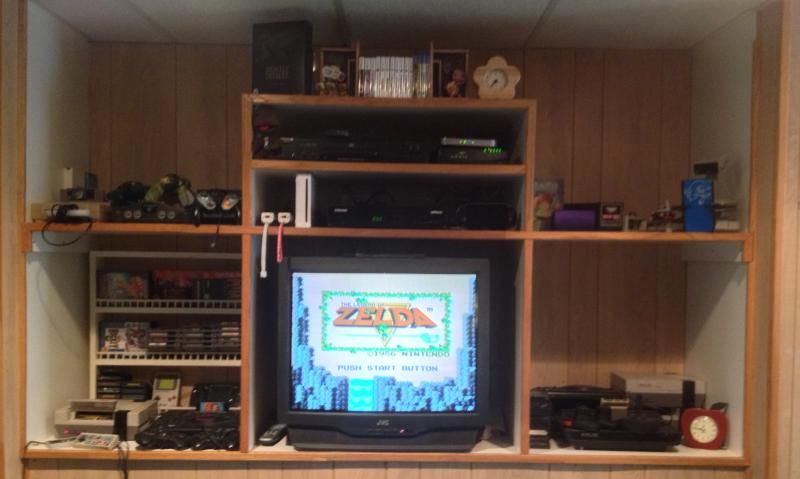

Got a retro room? Post it here!

![]()