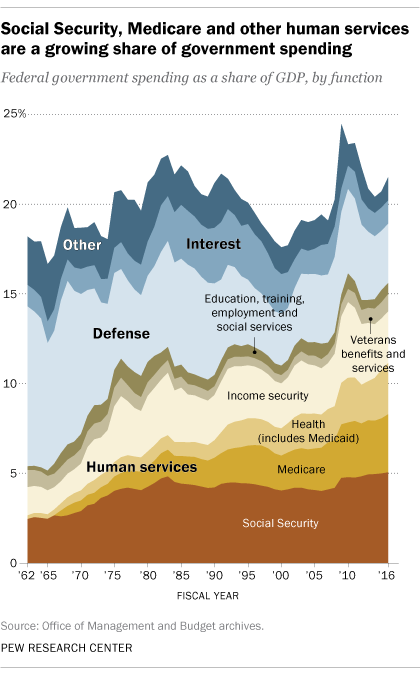

The government needs to leave the university scene.

As soon as they try to make it "cheaper" for all, the prices skyrocket. As they bring in more grants, more loan's, ect all it ends up doing is the colleges raise the price of tuition.

Look at the prices of tuition historically, then look at the prices of tuition once the government decided it needed to "step in" and make tuition more affordable for all. Prices have since been on a constant rise.

What is the government idea of a solution? More intervention. More loans, more grants, ect. All that will do is make Universities know they have more guaranteed money coming and thus raise tuition again. Students go into more debt again.