Normando said:

Kasz216 said:

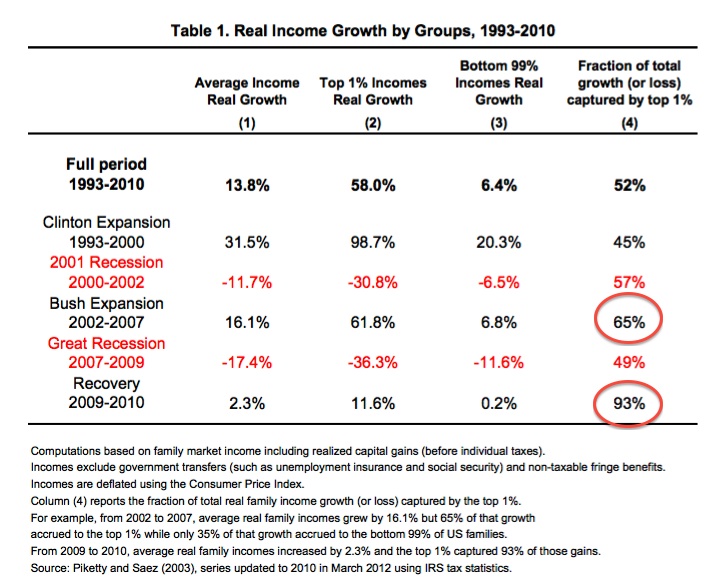

As teachers, you'd think they would know that the Gini Coefficient naturally grows in times of economic success and shrinks in times of economic contraction.

This is due to a pretty simple reality which is....Economic growth mostly happens through investment, either in building businesses or the stock market.

The rich have the money to do this. So they do... if they get 51% of the wealth created chances are the gini coefficient goes up.

This really isn't a problem at all... sure the regular people have a lower percentage of the money, but they have a higher amount of it... so they're better off.

To lower or maintain Gini Coefficent, you essentially would need to say to the rich... "You can keep less then half of what you make with money you already had that you invested at great risk."

HOWEVER there is one problematic reality with how things have worked lately. To be put in a second post because I imagine these two things would want to be debated separately if replied to.

|

Your statement ignores the reality of the 50's, 60's, and 70's where the economy was doing very well but income disparity was very low. History has shown us that the Gini coefficient is high right before economic trouble which can clearly be seen if you look at what happened in the late 1920's, the first couple of years of the 21st century and most recently in 2007. To a leser extent you could even include the mid 1980's in that list aswell.

It's also important to point out that although the economy goes grow through investment that it only grows through investment done here. As has been said in this thread already less and less investment is taking place in the United States because we cannot hope to compete with countries like China, India, and other Asian countries when it comes to production costs.

Your statetment about regular people having more money is misleading. Yes they do have more money but it's no secret that income has not kept up with inflation for regular people.

|

I feel like you didn't actually read what i wrote. If so... you didn't comprehend it.

The economy is larger today then it was in the 50's, 60's and 70's. Hence inequality has risen.

Also, inequality rose quite a bit in the 1970's.

It only didn't in the 1950's and 1960's because two things happened right before then.

It was called the Great Depression and World War 2... which led to

A) Such huge losses it massivly effected the poorer consumer first.

B) Forced Austerity in WW2.

When the economy drops so badly as to effect the little guy badly, the little guy must recover first. (Unless you dump a bunch of stimulus money onto the rich at the expense of the poor... which you know. Is why our recovery sucks now.)

Also, income has kept up with inflation if you count full benefits. Those who say they aren't are tricked by a slight of hand that only compares wages and does not consider full compensation.

They incorrectly use this.

Instead of this.

Or this.... (Women's data interesting too by the way.)

If you count everything that your average wage gets you now, even so low as a cheap healthcare plan at a supermarket chain. Compensation has grown.

You can of course argue that "one size fits all" benefits or something similar to it are different and an increase in actual wages would be better giving people free choice even if it means they'll get less value for their money if they try and buy the same things... but that's a completely different issue.

http://macroblog.typepad.com/macroblog/2005/12/are_workers_los.html

Quite interestingly...