That one problem?

The If the economy increases by 100%, then Decreases by 100% back to it's original level... the rich should actually end up with LESS money then they did originally... since the money created that moves down to the "poor level" is safer and in areas not prone to loss, and contraction always hits the top much harder, and often is mostly at the top.

So economic downturns actually naturally keep gini coefficent in check.

Lateley however, we have Economic Stimulus. Which mostly benefits the rich.

All one needs to do is look at today's economy.

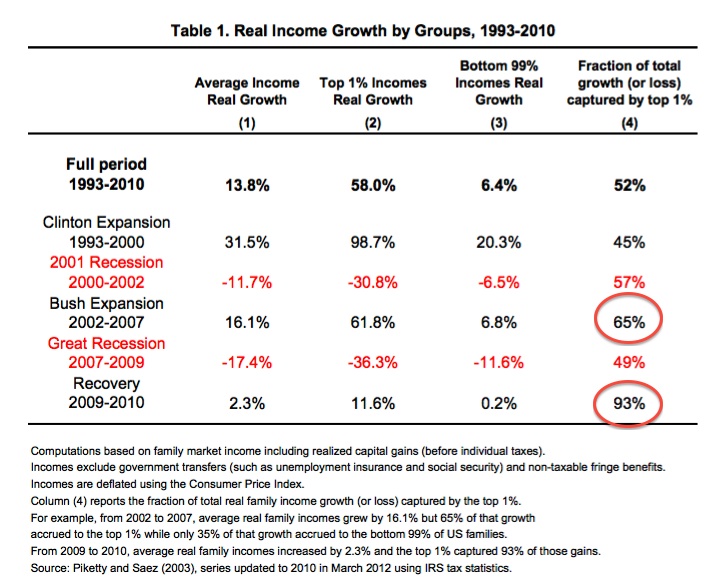

Tells the story pretty well. The Depression after the Clinton era actually caused the rich to shrink 57%. Vs the expansion where it grew 45%. We didn't see a need for a big stimulus then.

This time though? HUGE stimulus. It cushioned the rich peoples loss, then greatly fueled the rich peoples capturing of new wealth, as the poor and normal people have never really recovered... because well... poor people don't recover through stimulus. If we didn't bail out the wallstreet banks, the rich would of been hit MUCH harder. Believe it.

As such, Obama(and Bush) caused a ridiculious new precedent. If there is a longstanding 1% problem after that continues they created it.

Not through tax cuts or anything like that, but through stimulus. (Well and fed policy.)

It should be fine if we ever finally go through a few more recessions without major stimulus, or possibly if things rebound on their own (or it may have sent a permanent precedence based on this, i'm not sure.)

However if we're in a long term japanese holding pattern? We've got issues.