mai said:

Player2 said:

mai said:

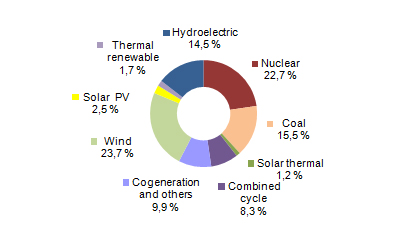

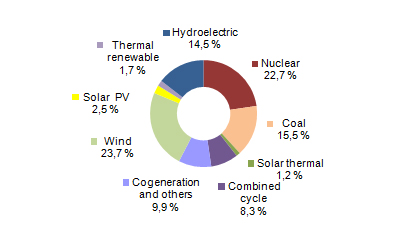

^In regards to the topics of renewables that have been discussed here:

Abengoa, the Teetering Sun King of Spain, Prepares for End Game

ROFL, bwa-ha-ha-ha. Told you :D

As much as any other parasitic sector of economy after attracting sizeable amount of fools' money (aka investors) it's nearing bankruptcy leaving nothing but debt behind. RIP, we hardly knew ya.

|

Abengoa is a bad example because it has been a scam, just like Bankia.

On the other hand, wind has been Spain's #1 energy source in the first quarter of 2015:

Ironically, Abengoa has produced 0% of it.

|

They're all a scam. The more debt problems government budgets that supports this will have in the future, the more of Abengoa and alike will bite the dust. The close correlation between the former and the latter is one obviouse evidence of inability of said enterprises to reach break-even point outside of some shady schemes.

BTW you chart looks like electricity generation not energy production, that's not a full energy balance of any given country.

|

You can't put all renewables in the same basket.

In 2012 the subsidies were:

photovoltaic - 400 euros per MWh.

solar thermal - 272 euros per MWh.

wind - 42 euros per MWh.

In 2014 Spain's wind subsidy went down to aprox. 20 euros per MWh.

My home uses an average of 0.2 MWh per month, so in a theoretical scenario where 100% of that energy is obtained from the wind we have to "pay" less than 4 euros per month more (and I'm being really generous here). That's a price I'm willing to pay for my independence.

Abengoa is a scam to siphon money from investors and taxpayers (through subsidies and contracts with the administration) to its executives. They achieved it by "hiring" ex politicians like Josep Borrell, politicians' relatives, like Miguel Sebastian's (Zapatero's energy minister) brother or Montoro's (Spain's current financial minister) partner in Montoro y Asociados or the King's cousin. That's why the photovoltaic and solar thermal subsidies are so ridiculous.

The chart is an energy generation. I couldn't find a pretty chart with the production numbers, but the 2014 numbers (it seems that only the yearly reports are in english, so no 2015) are in page 10 here:

http://www.ree.es/sites/default/files/downloadable/the_spanish_electricity_system_2014_0.pdf