I've actually got a more pertinent question. Is this being blamed on the old Karamanlis administration, or on Papandreu?

Monster Hunter: pissing me off since 2010.

I've actually got a more pertinent question. Is this being blamed on the old Karamanlis administration, or on Papandreu?

Monster Hunter: pissing me off since 2010.

If Greece did not raised the taxes, cut loans etc now;.;..your country could end up in a more worse situation.

If you are at a point of being jobless and you really don't know what to do anymore I can offer you a job in an another EU country (like Belgium), sadly it is working in a warehouse but you get 1400-1800 EURO a month and I am just saying you this because we already hired one Greece and three Portuguese who came all the way here to find a job;

| Akvod said: My Macroeconomic teacher stated that the second recession was caused due to FDR wanting to listen to the Classical economists, and balancing the budget that time, cutting back government spending, engaging in contractionary policy. Also World War II in itself, was a natural Keynesian policy. It was simply a natural way, of increasing C+I+Nx+G And it's hard to use monetary policy for expansionary policy when the interest rates are near 0. But, I need to study more, if I'm going to advocate to cut back on the expansionary policies now (now that the recession ended), keep it (because unemployment is still up), or to gradually cut back on it (as AD shifts right due to C, cut back on G)

|

Wow... your economics teacher should be fired. VERY FEW economists believe that to be the case. Heck these Greece crash was basically caused bt kensyian like economics. I mean, if you learned this in history class i'd understand... but economics? Awful.

It's a movement largely of laymans and polticians.

It reminds me of Freudian psychologists.

I mean heck, look at Greece to why it doesn't work.

Fruedian economics don't fix a depression faster... they smooth it's effects at the price of extending the depression.

| SamuelRSmith said: I've studied the graphs for hours on end, Akvod, and, frankly, all real world data points towards Government deficits being inflationary. Hell, inflation didn't really even exist in the USA before the 1900s, indicating that, actually, Government deficits are the sole cause of inflation. Now, of course, you can argue that it's because the deficit has been sustained during periods of growth. Which I agree with, and, in fact, the data also shows that if the deficit is quickly reduced, inflation will quickly fall with it. However, this is only when the deficit has come from the Government spending money on projects that have a greater long-term gain. If the Government borrows a tonne of money, for example, to improve the infrastructure, inflation will fall as the benefit derived from the infrastructure increases - in essence, as the projects pay for themselves. The problem is that during recession, and the kind of policies that Keynesian politicians usually go for - generating bulking deficits to increase consumption - are policies that not only don't generate as much long term benefit for an economy (£20 billion spent on subsidising cars will not generate as much long term benefit as £20 billion spent on roads, for example). It all just boils down to the fact that Keynesian economics are all ridiculously short-term. Unfortunately, the only terms shorter are terms of mandate for a Government, and they only really ever focus on the next 5 years, not the next 50. To quote Keynes, "in the long run, we're all dead". |

Frankly, you're denying things taught in Principle Macroeconomics class, but yes, expansionary policy, or in fact you can call it, INFLATIONARY policy are in fact, inflationary. All I'm saying is that if there is a DEMAND (not a supply, aka staglfation), there should be a reduction in output AND inflation rates. Therefore, increasing the aggregate demand curve, by increasing G, should bring it back to its original levels. Of course, you can also do this by increasing I (investment), by lowering the interest rates.

Monetary policy is the focus, but when Cramer is talking about "academic" he's talking about the Fed listening to FRIEDMAN, trying to priortize inflation and following an rule, rather than simply engaging in discretionary policies.

Kasz216 said:

It's a movement largely of laymans and polticians. It reminds me of Freudian psychologists. I mean heck, look at Greece to why it doesn't work. |

So... consumer confidence is a myth? Greeks are in the mess, because they engaged in expansionary/inflationary policies, when they were ALREADY in equillibrium.

I should clarify, I'm advocating NEO-Keynesian, who accept that in the LONG RUN, expansionary policies only result in inflation.

You guys are being CLASSICALISTS, who believe that any inflationary policy, both in the long AND SHORT term ONLY result in inflation.

Let me ask you all of you guys one question.

Do you believe in sticky wages? If yes, you are an Keyensian, or at best, a Neo-Classicalist.

Akvod said:

So... consumer confidence is a myth? Greeks are in the mess, because they engaged in expansionary/inflationary policies, when they were ALREADY in equillibrium.

I should clarify, I'm advocating NEO-Keynesian, who accept that in the LONG RUN, expansionary policies only result in inflation.

You guys are being CLASSICALISTS, who believe that any inflationary policy, both in the long AND SHORT term ONLY result in inflation.

Let me ask you all of you guys one question.

Do you believe in sticky wages? If yes, you are an Keyensian, or at best, a Neo-Classicalist. |

Neo-Keynsian economics are still behind the curve and just about as dead as Classical Keynesian economics.

Most Neo-Keynsian's have backtraked even further that Neo-Classical economists were right on everything but Macroeconomists.

| SamuelRSmith said: And, yes, I forgot, deficit spending, indeed, all debt spending, requires an increase in the money supply to actually happen. The Federal Reserve isn't the only body in the USA which can create money, you know. Every single bank in the USA has the ability to create money. When you take out a loan of, say, $20,000 the bank will "create" a large chunk of that money. The difference is that when you take out your loan, or a mortgage for $200,000 the amount of money created is infinitesimal, especially when compared to the amount of money created to fund the trillions required for the Government's debt. |

The bank can only "create" money by lending out money from its bank reserves, thus increasing the money supply. It gets those money from the Fed. They don't have a damn printing machine, all they can do, is hold onto the real cash they have, and loan it out, which will be spent, saved, loaned out, on and on.

In short, the banks cannot increase the money BASE, only the money supply, and they only hold onto money for the sake of finding the best loan, not because they have an interest in monetary policy...

You're so fucking confusing me.

| Kasz216 said: Neo-Keynsian economics are still behind the curve and just about as dead as Classical Keynesian economics. Most Neo-Keynsian's have backtraked even further that Neo-Classical economists were right on everything but Macroeconomists. |

...?

All three are Macroeconomic views... typo on the last sentence?

Neo-Classicals try to rationalize the Classical view by saying that people are perfectly rational, and are aware of everything the government does. So any discretionary policy will backfire, because they will simply raise their expectation of inflation.

... although I asked the professor in lecture why those people didn't simply adjust their expectations to the equilibrium beforehand... but he said that a more complex explanation will be something irrational like stock markets... but it sounds pretty crappy to me.

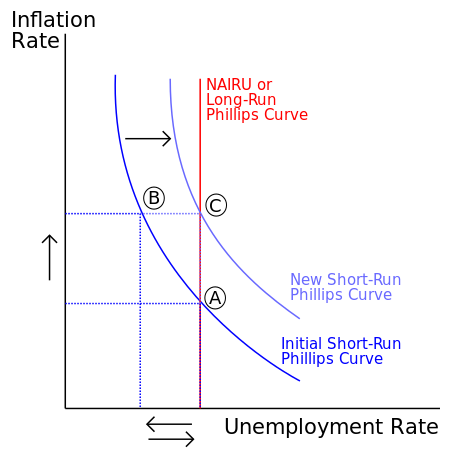

For reference.

So Neo-Classicalists are saying that if there was point A', which is A moved rightward (low inflation, and high unemployment), raising the inflation rate (moving the point back to A), will only result in a shift to C' (C, moved rightwards so that it has the same unemployment level).

The question is... why didn't those oh so rational people move their expectation so that the curve will shift down, and result in lower inflation and natural unemployment rates?

Akvod said:

...? All three are Macroeconomic views... typo on the last sentence? Neo-Classicals try to rationalize the Classical view by saying that people are perfectly rational, and are aware of everything the government does. So any discretionary policy will backfire, because they will simply raise their expectation of inflation. ... although I asked the professor in lecture why those people didn't simply adjust their expectations to the equilibrium beforehand... but he said that a more complex explanation will be something irrational like stock markets... but it sounds pretty crappy to me. For reference.

So Neo-Classicalists are saying that if there was point A', which is A moved rightward (low inflation, and high unemployment), raising the inflation rate (moving the point back to A), will only result in a shift to C' (C, moved rightwards so that it has the same unemployment level). The question is... why didn't those oh so rational people move their expectation so that the curve will shift down, and result in lower inflation and natural unemployment rates? |

No. All 3 aren't purley Macroeconomic views. They are economic theories in general. For both Macro and Micro economics. After WW2 the Macroeconomic views were absorbed with Neoclassical views.

Largely the Macreoeconomist views of Keynsians are never widely accepted because they have no microeconomic basis.

Neo-Classical Syntehsis tried to happen to provide Keynsian economics with that base.

Additionally New Keynsian economics have tried to provide a microeconomic base actually using congruent theories.

You really need to define what kind of Keynesian you are... for what it's worth... New Keynesian's would actually disagree with you. So I hope it's not them.

Sigh... let's go through basic macroeconomics guys.

So, here we have the AD/AS model. We also acknowledge there is a LRAS, which incorporates some classical ideas.

Aggregate demand slopes downward because:

Ceteris parbus. Keeping all else the same, if you have the same wages (sticky wages), but there is inflation, you have less real purchasing power (If bottled water went from a dollar to 2, you have half the ability to purchase it), and therefore, demand less goods, at that price level.

Another one is that if inflation goes up, nominal interest rates go up, reducing investment.

Let's recap here that GDP=

GDP=Investment+Consumer consumption+Government spending+(Exports-Imports)

So, a shift in one of these things, is a shift of AD.

Consumer consumption is shifted by things like consumer confidence, and other things. Let's say that the stock market crashes. Income didn't change, you still have just as much cash to spend tomorrow, but you cut back on spending, because you feel less wealthy (or recently another asset, REAL ESTATE, lost value).

Aggregate Supply, is downward sloping, because if the cost to produce something (say 100 dollars to produce a Xbox), but aggregate price goes up (Xboxs are now 400 dollars), you make more profit, and therefore, you're willing to produce more.

So, if wages stay the same, but there's greater demand for goods, then producers will make more. If there is say, an input that becomes expensinve (OIL), then producers will be less willing to produce things at every price level.

Long run supply curve.

In short, EXPECTATION of inflation is what ties this, the long run philip's curve, NAIRU, etc together.

If, say, the government engages in inflationary policies, even when we are at the natural rate of unemployment (say, giving lots of government jobs and building bridges to nowhere), then what will result is more output, but also HIGH INFLATION.

As a result, as a worker, you will knock on Boss Joe's door and say "Hey um, everything's two times as expensive. So can I have two times my wage?", strikes, labor economics happens, and boom, eventually wages increase, they're not sticky in the long run.

Well wages, are just another input, like oil. So then if the cost to make a product is more expensive, then the supplier is willing to supply less at every price level, and the AS shifts left.

Well if AD and AS shifted, then all that happened is price level shifting upwards, but output staying the same.

So moral? You can't change the long run supply curve (unless you shift out the PPF), so promises to reduce unemployment for election, and government is bad. Discretionary is bad (Friedman).

Orange shifted right, light blue shifted left.

Orange shifted right because of increased G

Orange shifted left because wages adjusted in the long run.

But what if there is an demand shock? Say, real estate values fall (wealth effect), and consumer confidence walls (animal spirits, according to Keynes)

Well, we have DISinflation, and lowered output.

Well perfect, all we need to do is LOWER the INTEREST RATE.

Remember. GDP=G+C+Nx+I

So increase I.

But what if you did that, but interest rates are already or at (like Japan, which is a really weird case) 0?

You can't lower the interest rate beyond 0.

What do we do?

Increase G