NJ5 said:

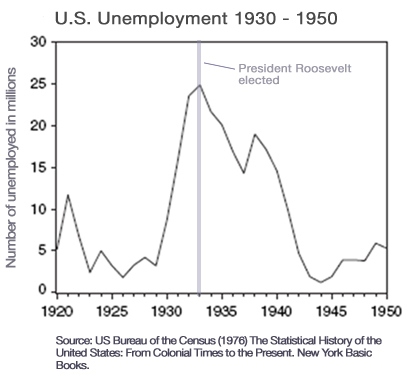

Over indebted consumers and the consequence to banks was the reason the recession started, so there's a reason for people to focus on those aspects. I don't think the Great Depression ended due to higher government debt. In fact the public works projects were seen as failures, and the Keynesians said the government wasn't spending enough. Look at Japan and Sweden. Their banking crises only ended when the government forced an audit of the banks and let the insolvent ones fail. Shifting debt around and hiding it has never worked so far...

|

Actually it did, WW2 was a public works project, and it sent the government into massive debt for the time to fund it, it put millions of unemployed to work, the problem with the New Deal was it wasn't big enough, WW2 was big enough.

Predictions:Sales of Wii Fit will surpass the combined sales of the Grand Theft Auto franchiseLifetime sales of Wii will surpass the combined sales of the entire Playstation family of consoles by 12/31/2015 Wii hardware sales will surpass the total hardware sales of the PS2 by 12/31/2010 Wii will have 50% marketshare or more by the end of 2008 (I was wrong!! It was a little over 48% only)Wii will surpass 45 Million in lifetime sales by the end of 2008 (I was wrong!! Nintendo Financials showed it fell slightly short of 45 million shipped by end of 2008)Wii will surpass 80 Million in lifetime sales by the end of 2009 (I was wrong!! Wii didn't even get to 70 Million)