Interview/Meeting Between Jim Ryan and Analysts at Fidelity - After ABK and Bungie Acquisitions (February 2022).

Questions = Analysts / Answers = Jim Ryan.

Q: Bungie has 1,000 employees and 20-30 years of history making games. You're counting on a big contribution from them to help you with these 10 games and help you to allocate capital effectively as well as avoid making mistakes. Is that the strategy?

A: Yes, it is. I've been talking a lot over the past couple of years with our publishing partners, many of whom are slightly farther down the road than we are in terms of live service publishing. What they al have in common is that they've made a lot of mistakes on that road. And |think one of the benefits of being a fast follower inthis space isthat ifwe're intelligent and thoughtful, we can learn from those mistakes. But these partners can be viewed as our competitors and there's a limit to what they will share. Having a premier live service publisher within the group who is extremely keen to collaborate with Sony massively increases our ability to learn and our ability to avoid the mistakes that others have made.

Q: You've made it very clear that there's going to be more acquisitions to come. What is an ideal acquisition target and what are you hoping it will help you achieve?

A: I think an ideal acquisition target has to help us deliver on our strategies in a way that we're not capable of doing on our own. And when |look at our portfolio of studios and our publishing capabilities, we need help in the areas in which we're not strong at present. We aspire to grow our community, grow engagement with our games, grow the number of people who are playing those games, grow the amount of time people are spending on those games, move across to PC and mobile, and grow the number of people playing with each other. It's in these spaces, where we don't have expertise and presence, we need to build expertise. These are some of the reasons behind the acquisition of Bungie. We have publicly stated ambitions in the area of mobile. That's part of game development that we've not been present in any meaningful extent. So, you can assume that we have an interest in acquiring development knowledge and management expertise there.

Q: Did you look at Activision as a target? Was it too big to buy?

A: We know Activision extremely well. They are probably one of our principal partners. In terms of deployment of Sony's capital, when you look at 69 billion dollars for Activision compared to 3.6 billion dollars for Bungie, we believe that Bungie can give us way more than a 69 billion acquisition of Activision. And that's before considering the relative value of that particular transaction.

Q: PlayStation is very important to Activision. In the next decade, is Microsoft going to turn off their supply of games to you?

A: I honestly believe that that will not happen. We continue to talk with Activision. I talk with Phil Spencer at Microsoft. We're having good conversations. They obviously have significant regulatory hurdles that they must navigate to get this transaction cleared. And ongoing availability of Activision games on competitive platforms is going to be central for them to be successful in that mission.

Q: Given the rapid change in competition in gaming, are there some potential M&A opportunities that are larger in size that you would consider? There are some unique software assets not focused on gaming such as Unity, Roblox and Epic for example. Are those targets you might consider going forward?

A: I go back to the comment that |made earlier that a necessary condition for us to consider when making any acquisition is whether it helps us advance our basic strategy of growing our first party publishing business across multiple formats in a way that we have not in the past. And if a potential acquisition ticks those boxes, itgoes on the list.

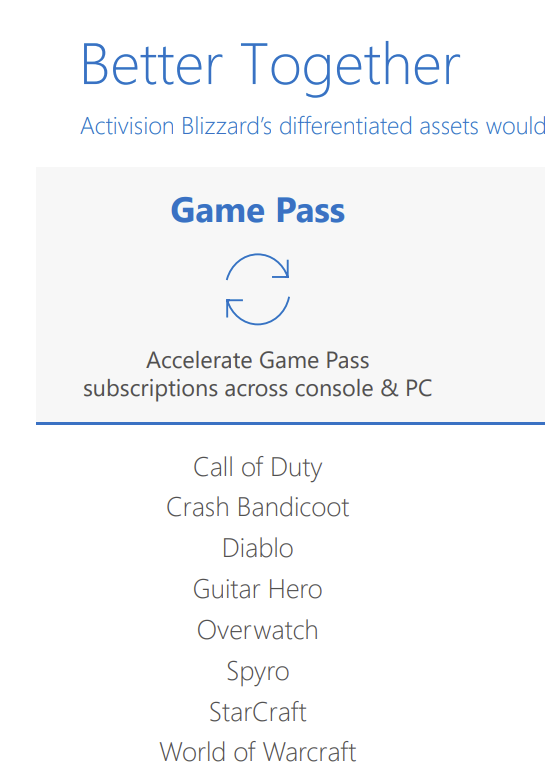

Q: The Game Pass business model appears to have some challenges, and Microsoft appears to be losing a lot of money on it. Because the AAA publishers spend $100 mil or more on developing titles, they are happy to sell it for $70 on PS5. The subscription model is more challenging for them. Given that environment, will Microsoft need to provide minimum revenue guarantees ifthey want those titles on Game Pass? Or do they need to go out and buy more assets like Activision to put on their platform? Are those the two options for Microsoft when trying to gain critical mass and support from the AAA publishers for Game Pass?

A: | can say with a very high degree of certainty that Microsoft has tried the first path and it did not work at all. That has driven them to make the large acquisition. |'ve talked to al the publishers, and they unanimously do not like Game Pass because it is value destructive, not only on an individual title-basis, but also on an industry level. The recent number of subscribers that Microsoft announced on January was 25 million. I am sure everyone has their own views on this, but | personally was expecting a larger number given al the money they have spent. We have close to 50 mil PS Plus subscribers. We believe we have a meaningful subscription service.

Source: Idas