I don’t think there are currently any other companies out there that have the means and the will to purchase ABK, for a variety of reasons: 1. He asking price would probably have to go up substantially to justify being stuck in another 18 months of regulatory limbo. Think instead of $70 billion more like $100-$110, which is basically the entire market cap of Sony. 2. There are basically only 3 companies on earth that could make that purchase, Apple, Amazon, and Google. All 3 of these would face the same or more regulatory scrutiny that Microsoft did if they attempted this purchase. 3. You would have to convince the thousands of shareholders all over again to keep the company in regulatory limbo for another 18 months its simply not a realistic outcome |

The 3 companies that come to mind are Apple, Google and some Saudi interest. The reason why either would consider getting ABK is simple. They all are looking to expand more into gaming. Its been rumored that Apple is seeking some type of console entry. Google is also looking to get into gaming and we already seen Saudi interest in the market.

My prediction is that gaming will all come together very soon. Meaning that all games on all platforms will be playable on all devices. Subscription services will dominate this space and thus companies positioning now will be ahead of the game. MS is going full steam ahead, Sony is taking their time and Nintendo I am not even sure cares as they may just carve out their own space. That leave the other players trying to get into the market like Apple, Google, Netflix, Amazon, Tencent you name it.

The only players that will be able to truly compete have big money. MS has shot the first couple of broadsides with Bethesda and ABK, I only expect to see more shots fired in the future.

As for regulator scrutiny, I doubt it. MS is already in the market and this is a vertical merger so Apple or Google would have no problem as they do not have the same situation as MS.

As for the shareholders, that is another situation since all their shares has voting rights so in that respect is where the challenge would be.

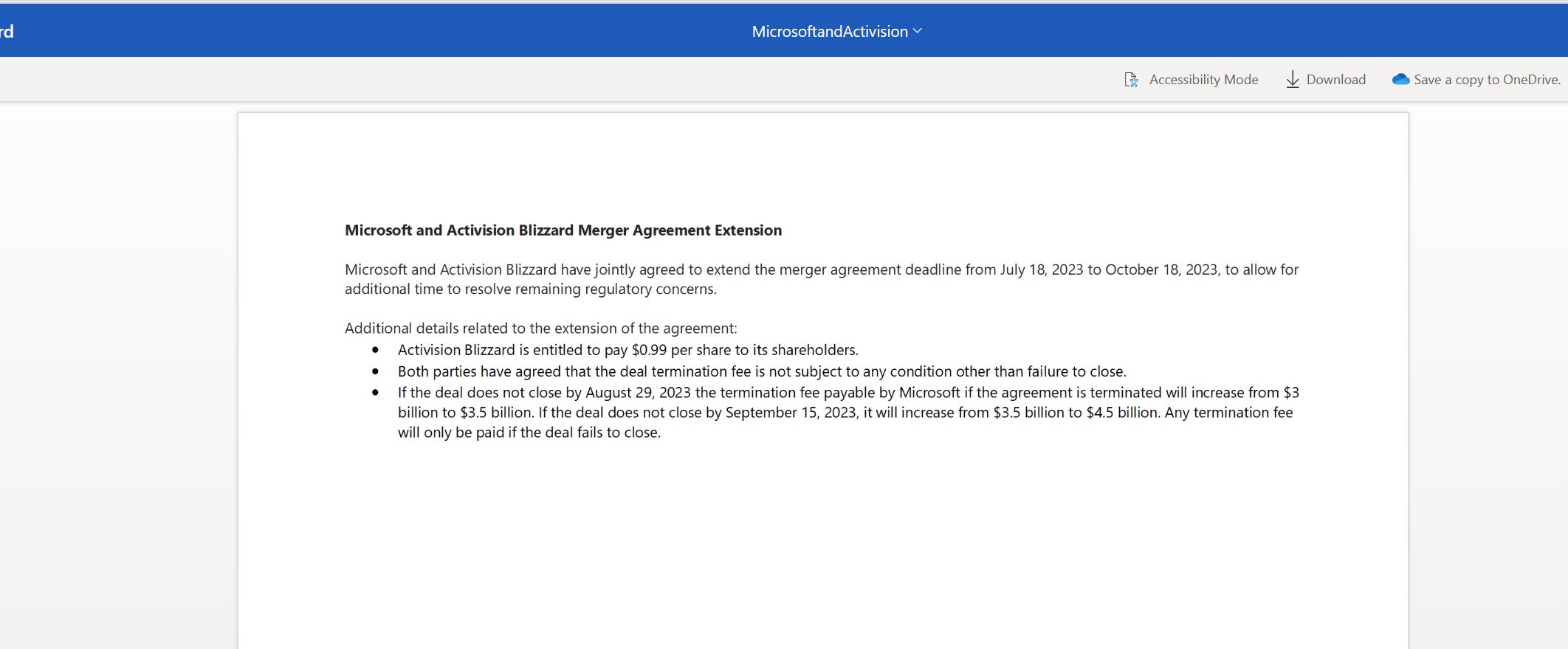

of the Merger Agreement solely to permit the Company to declare and pay one regular cash dividend for fiscal year 2023 on Company Common Stock in an amount per share of Company Common Stock not in excess of $0.99, for the avoidance of doubt, prior to and not contingent on the Closing.

of the Merger Agreement solely to permit the Company to declare and pay one regular cash dividend for fiscal year 2023 on Company Common Stock in an amount per share of Company Common Stock not in excess of $0.99, for the avoidance of doubt, prior to and not contingent on the Closing.