Aielyn said:

Kasz216 said:

Aielyn said:

1. So what you're saying is that the housing issue wasn't an issue at all in Australia. Which doesn't challenge what I said, that the GFC outside of America wasn't due to local housing bubbles, but because the rest of the world uses the US dollar as the international currency, and because American banks are so tied to other banks. So when America's financial system melted down, it took the rest of the world with it. But Australia still managed to survive it without going into recession.

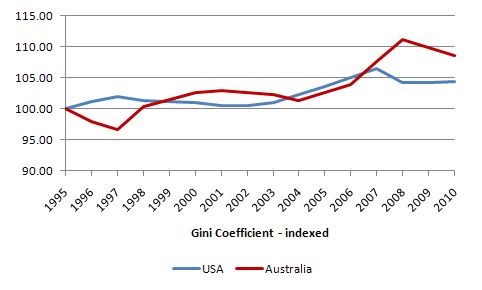

2. Not sure what you're trying to say, here, but there's absolutely no doubt that the reason for the change in trend in terms of inequality is that our Labor government (Labor is the Australian equivalent of the Democrats) instituted changes that helped to reduce inequality. The American downturn was due to the GFC. Remember, the GFC didn't drive Australia into a recession, so its impact was muted over here.

3. I meant instability of growth - more likelihood of growth going negative. As I pointed out, Australia didn't go into recession, despite higher taxes for the rich (and lower for the poor). What kept Australia from recession, really, was that the government acted swiftly with a stimulus package designed to simultaneously benefit the country in terms of things that we need and the creation of jobs to provide them. The money was spent on schools, on hospitals, on roads, and on providing subsidies for ceiling insulation and solar hot water systems (thereby reducing energy costs). They also provided financial benefits to low- and middle-income families, to students, and to farmers and farming-based small businesses. The result was lower inequality and the prevention of a recession.

4. I have the same problem with the European Union as I do with the United States. If your country is too large to manage well, maybe you should consider separating into multiple smaller countries. And curriculums shouldn't interfere with making sure that minorities are brought up to speed - you just incorporate things into the curriculum to ensure that it's all covered. Although I must ask why a "racial minority" wouldn't be able to succeed in any particular class. Also note that Australia has more ethnic diversity than America, and our education system doesn't really harm any particular "minority".

5. The reason why the US dominates so much in journals is that you're 15 times the population of Australia. China, of course, is catching up as it modernises, because they've got a massive population base... but until relatively recently, science wasn't big in China. And "free college for all" isn't what I'm referring to. It's "free college to anyone who satisfies entry requirements". Here in Australia, what happens is that the number of available places in a particular course is set, and then those places are filled in order of achievement - that is, how well you did at school (or equivalent, if mature-aged). So the cost doesn't blow out, and the value of the degree doesn't get depressed. We also have what is called a TAFE system ("Technical And Further Education"), in parallel with universities, but focusing on the less intellectual pursuits - so you go to TAFE if you want to, for instance, be a mechanic.

6. Shrinking doesn't fix it, that's the problem. If you want to fix it, you should start by simplifying it - get rid of all of those stupid patches that were put on the system, and instead spend the time closing the loopholes properly. Loopholes, by the way, in both directions - both tax loopholes and spending loopholes. And as I pointed out, the biggest problem is that you have a system that works on a two-party basis, which has produced a duopoly. Here in Australia, while it is true that we have two (technically three, but two are in an official coalition) major parties, we also have rather powerful minor parties and independents, who currently hold the balance of power in both our House of Representatives and our Senate. It forces the major parties to be a lot less self-interested.

Here's a description of a simple blueprint for fixing America's system:

1) Change your electoral system from first-past-the-post to preferential, and eliminate the "electoral college" system. This will enable a thriving ecosystem of parties, rather than just Democrats and Republicans. Perhaps consider making attendance for voting mandatory (actually voting wouldn't be necessary, as long as you show up (or equivalent - postal/early attendance is fine) - people are more likely to get involved and actually vote if they have to attend anyway).

2) With that done, work through the tax system, eliminating as much complexity as possible - that is, for instance, eliminate income tax on the poor, and eliminate the tax breaks that counter that 10% tax, so that the same people pay no tax, but without the extra bureaucracy and complexity. If necessary, simplify to a three-level tax structure, with, say, 0% tax up to $15,000, 20% tax up to $250,000, and 40% tax above that. You can tweak it later.

2b) Close the loopholes in the tax system. Make sure that millionaires are paying more (by percentage) tax than middle-income earners. Make sure that large corporations can't arrange things so that they pay zero tax, and convert to a local-only tax system.

3) Build a set of strict rules regarding lobbying, in order to reduce the influence that lobbyists have on the government.

4) Improve your welfare system and your primary/secondary education system. Privatise social security, but with a backup pension system for those who will need it - use the Australian system as a guide. Establish a national curriculum with room for certain forms of local variation in order to ensure maximal results, and provide federal funding for schools, beyond the state funding. Allow even private schools charging less than a certain amount per head to get some government funding (less than what public schools get, though), thereby providing incentive for private schools to cater for lower income levels.

5) Look at Canada's health system, and consider emulating a number of features from it in your public health system. Canada's system blows America's away. This doesn't mean that you can't have a thriving private health system - you just make sure the public system is focused on those things that are good for society - in other words, elective surgeries, for instance, are for the private system.

There are other things I'd do, but they're a lot more focused on my opinion rather than objective observation compared with what I've listed above. For instance, I'd nationalise the sales tax system - it's absurd that each state sets its own sales tax, nowadays (thanks to the internet, etc). I mean, my ultimate belief is that a sales tax shouldn't be necessary to begin with, but at the very least, it should be standardised, in my opinion. But it's not a necessity for fixing the system itself.

killerzX - not sure what point you're trying to make. Are you trying to say that because she identifies with Cherokee Indians, she is therefore not making a valid argument on taxation? You can think what you want of her regarding that issue, but it has no bearings on the validity of her argument regarding fair taxation and the comment she made.

|

1) There were housing bubbles pretty much everyhwere though... and signs of it failing in other countries well before the GFC.

2) I'm all for closing loopholes.... and millionaires do pay more in taxes then the middle class. The only people who don't are those very few who aren't taxed almost exclusivly on the income tax, but the capital gains tax...(The amount of people like this are like maybe 400.) Which Austrlia has at a lower price then regular taxation as well.

Also worth noting... your exmeptions for the poor are actually lower and when you account for the breaks. USD/AUS is about equal. Thing is, your 0% Tax Bracket at 5,000. Our 10% bracket ends at 17,000. Our 15% bracket ends at 69,000 vs yours ends at 37,000. It's not just the rich who have a lower tax bracket then Austrlia.

3) Except... it wasn't. Austrlia didn't put those measures in, and they didn't apply until well after they should of felt effects and didn't. Austrlia didn't have issues because they were tied strongly to nin Japanese asia and deal in commoddities.

4) I wouldn't disagree with any of that... outside arugeably the national curriculum due to educational inequality worries.

5) Funny thing is... a lot of Canadians disagree. Also the US government doesn't run their healthcare much differently from the canadian system that i can see.

|

1. The point is that housing bubbles bursing elsewhere wasn't the cause of the GFC. The GFC was caused by the bursting in America.

2. I admit that capital gains tax in Australia also needs reforming. I'm not claiming that Australia is perfect - there's quite a few things that are flawed in Australia, too.

As for tax brackets, you forget that you need to work out the actual results, rather than just looking at percentages and end points. More importantly, you seem to be looking at the Married brackets, whereas the Australian ones are listed for individuals only. For convenience, I'll use this notation: "AU-1" means "first Australian threshold", "US-3" means "third American threshold".

At $6000 (AU-1), we pay $0 tax, Americans pay $600 (+$600).

At $8700 (US-1), we pay $405, Americans pay $870 (+$465).

At $35,350 (US-2), we pay $4402.50, Americans pay $4867.50 (+$465).

At $37,000 (AU-2), we pay $4650, Americans pay $5280 (+$630).

At $49,600, both Australians and Americans pay $8430 (+$0).

At $80,000 (AU-3), we pay $17,550, Americans pay $16030 (-$1520).

At $85,650 (US-3), we pay $19,640.50, Americans pay $17,442.50 (-$2198).

As you can imagine, the difference grows more beyond there, since the Australian rate is already 37% while the US rate is just 28% and never goes above 35%. So essentially, everyone below about $50,000 a year in Australia pays less tax than in America, whereas everyone above that pays more than in America. Just for completeness, at our last threshold, $180,000, we pay $10,622 more than America does, and at your last threshold, $388350, we pay $35,624 more than America does. A millionaire in Australia pays 42.36% of their income in tax, whereas a millionaire in America pays 32.68% of their income in tax.

Regarding the impact of marriage, that's a different issue, and a complicated one at that. There's lots of room for massive debate over things like whether couples should be treated like their combined income is shared evenly between them, whether marriage should provide tax benefits (and doesn't this encourage marriage for the sake of money?), etc. Since it's such a large kettle of fish, I'll leave it alone. Suffice it to say, the fair comparison is individual rates vs individual rates.

3. You forget that I LIVE in Australia. I know all about the timings of things. Those stimulus elements were put in place as the GFC built up its pace outside of America. The GFC hit America first, for obvious reasons. It took time to impact everywhere else. And no, our connections with China don't explain it, either. I feel I should point out that international economists, including those of the IMF, attribute Australia's avoidance of the recession to the government's actions.

5. http://en.wikipedia.org/wiki/Comparison_of_Canadian_and_American_health_care_systems

And I wasn't saying that you should copy Canada's system. You should emulate a number of features from it. Others should not be implemented. Just as Australia's system isn't perfect, neither is Canada's. The biggest problem is that wait times are too large. But that's more to do with number of doctors vs number of procedures needing to be done. I'm sure there are Canadians who dislike their system. But the numbers tell a different story - Life expectancy is higher in Canada (and Australia), infant mortality is significantly lower, per capita spending on health is roughly half, and costs relative to GDP are significantly lower. When another system is working, on the whole, better than yours, you should compare them to figure out what is making the difference. Then you should try to make a system that works even better than that.

|