SvennoJ said:

EpicRandy said:

Yes, that's very the main component of the deal IMO, people view $70B and I think they unconsciously associate it with the console market due to AB's history before they added K.

During the FTC trial, it was stated by an analyst (not in the actual case but one following it if I recall correctly ) that King was bought for $10B and that ABK has grown the value of K like 5x since. This might have been an exaggeration but, the way I understand things King makes more than half of the $70B valuation. Also of the rest of the valuation, another 50% or so of CoD's actual value is also tied to Mobile which I believe is separate from kings value. That means the overwhelming majority of that $70B is tied to mobile. Someone can do the math and proper research, and this is only a wild guess, the nonmobile value part of the transaction might only be in the teens.

MS have barely any presence in the mobile space making all the valuation tied to mobile at 0 risk of creating an SLC, moreover, they want to challenge an established duopoly in this space which means competition and clear benefits for consumers.

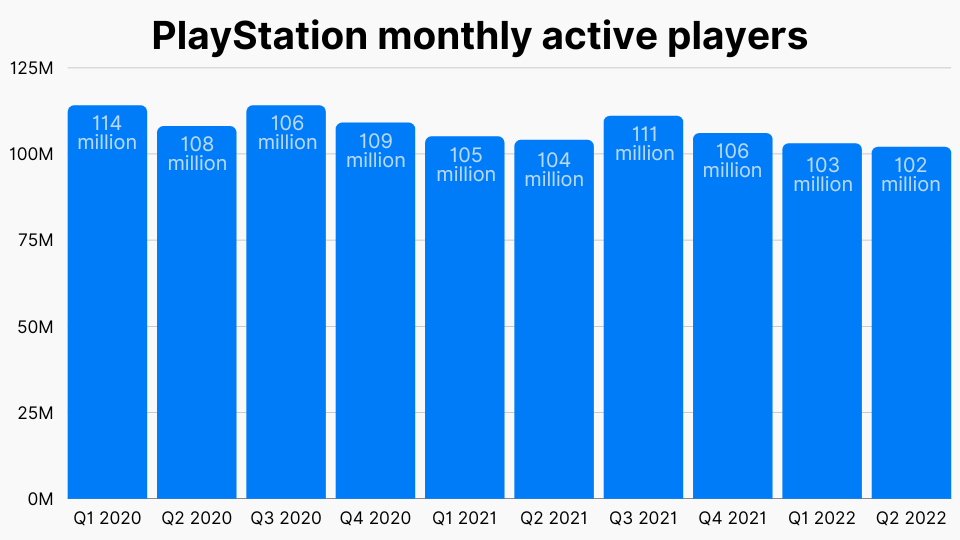

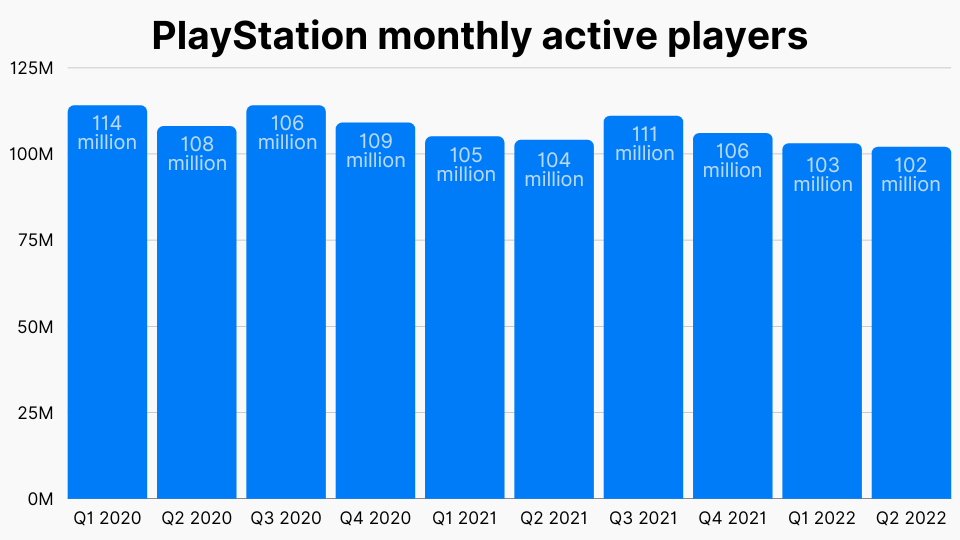

That said the graph I have shown mentions Digital so I don't know if it excludes physical copy and create a skewed representation for mobile since mobile is by default 100% digital. Yet, it does not really matter since we know video game companies non-mobile included made records profits due to covid and it looks to have a lingering effect on the market still creating a propitious context for investment which was the point of the prior post.

|

Consolidation typically happens in a stagnant / shrinking market though. Profits in console gaming revenue aren't soaring, hence game studios and publishers are up for sale...

ABK was losing revenue when they started the deal https://www.macrotrends.net/stocks/charts/ATVI/activision-blizzard/gross-profit Yes, the pandemic infused extra money into the entertainment sector, but that effect is done.

XBox Mau has been growing a lot but that's muddled with needing a XBox account for things like Minecraft on other devices. MS gaming revenue fell a bit as well but it's all hard to tell with the way stuff is reported.

I don't know if MS challenging the mobile players has any clear benefits for us, by which I mean gamers playing on TV / monitor. All those lovely franchises ABK is sitting on are more likely to get mobile spin offs instead of a revival for PC/console. Just like Sony is suddenly heavily investing in GAAS at the detriment of their regular release cycle, so I can see MS shifting focus to the more profitable mobile space, taking popular IPs there.

|

It has very little to benefit us as console /pc players, but mobile players stand to gain from an increase in competition in that much more consolidated market.

That's another area where I take issue with the previous CMA decision, they balanced the cons seen in the cloud market to the goods it may bring to consumers of GamePass while they did make any mention of the potential benefits from any, not even a slight, increase in the console market competitiveness and more importantly also did not contrast it with the benefits of challenging the established duopoly in mobile space where MS is one of the only very few entities that could even think of tackling that task.

As for Xbox shifting some focus to Mobile, it very well might happen and by all mean it is happening with this transaction, after that, I think furthering that venture will happen the same way it happened with ABK, through further acquisition, expansion, and contractual development agreement with 3rd party. The thing is, you don't necessarily want to retool and reskill established talented individuals at your studio while they are still making good output in a still lucrative market so other options will be preferred.

Last edited by EpicRandy - on 14 July 2023