kanageddaamen said:

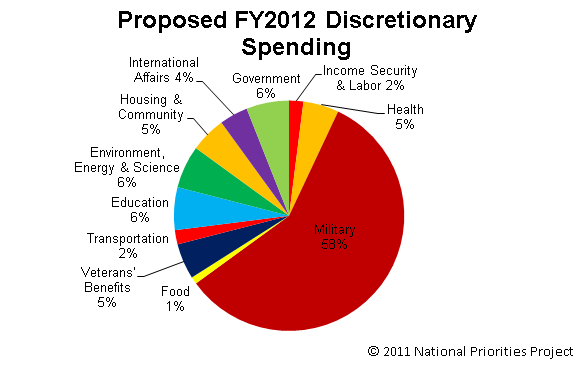

Right. We are talking about the Income tax rate. Social security and medicare are not paid for by Income tax. And I don't see the argument that social security is paid for via income tax, except for interest on the bonds purchesed which is a tiny portion of the total Social Security spending. Social security is funded by the payroll tax, and up until recently (deficit the last few years) the surplus went to purchase bonds and that money was used to fund other things. That way I could see the argument the payroll tax ends up funding discretionary spending, but not the other way around. EDIT: Something to illustrate the point |

Except social security benefits are mostly paid for from matured social security bonds... which is paid by payroll taxes.

Though, lets take this another way then.

By your logic... payroll and Medicare taxes should be regressive.... and BRUTALLY so.

Since the rich aren't really getting much if any benefit from Medicare or Social Security... and if anything are likely losing money on the deal.