mirgro said:

My American Hisotry is a little rusty so bear with me. If I can remember one factor was the simple fact that more goods were produced than people could buy. All the money was kept at the top and since the top people are so few in number and don't need everything produced they didn't buy anymore, meanwhile the lower classes just didn't ave the money and then the businesses didn't get their money back so they became poor too.Regulation could have prevented this. Then this is the big one that I can remember, the margin requirement for investment was just 10%. For every 1$ I invested, brokers would just give me 9$ as a loan and voila. Huge amounts of people bought huge amounts of stock, and the moment all the brokers wanted their money when things got dicey, the other people couldn't pay. This led to the huge bank runs and the stock market crash. If there was more regulation such would also not happen. It was caused purely by the greed of the people. All this is also ignoring the fact of how the current mess of things happened, which is directly linked to unregulated greed of businesses. People are bastards and assholes, they don't give a shit and hence to prevent a widescale tragedy regulation is needed. |

Wrong, wrong, and more wrong.

I'd reccomend reading up on the depression, and looking at metrics such as GDP growth/contraction as well as unemployment, and how such changes correlate to actions taken by businesses and government and see which one made the worse mess of things.

Lets start out with this, which we can all agree on:

The depression officially 'started' on October 29th, 1929 during the stock market crash. We can all agree on that, yes?

But the critical thing is what policies took place after the stock market crash - as the major indicators of wealth and productivity (GDP, unemployment, industrial output) did not take a sharp downturn in 1929...They took place in mid 1930, which is when the real crap hit the perverbial fan.

Here are a few charts to note this:

Now, we can note when October 29 was...There was a slight uptick in unemployment.

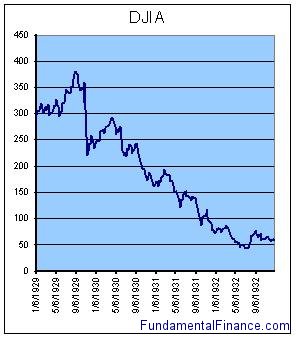

Also, lets note the severity of the crash:

Lets note a few factors about this:

- The market crashed 17% in a month during October

- There was a 15% increase between the crash, and the first few months of 1930

- It began a horrendous decline in May of 1930, which saw it lose about 80% of its value in 1 year and 6 months...Which correlated with us going into the real horrors of the Great Depression

So lets think about it:

Was the crash of '29 what caused the Depression?

Although we can all agree that is when it started, there isn't enough evidence to state that the Depression was entirely caused by the stock market alone.

Why? That was not the last time the stock market crashed in American history.

When else has it crashed? There are a few recent examples:

Crash of 1987 (S&P lost 20% in a matter of days) aka 'Black Monday':

(For reference, the DJIA shed a much larger percentage in 1987 than it did during the crash in 1929)

Crash of 2008 (Lost 45% of its peak value in just over a year):

So then, we have to look at other correlative factors after the crash that also helped cause the great depression. I will not argue that the crash caused problems, because it obviously did. However, there are many other factors that we can look at including the Dust Bowl of 1930-1936 and other economic policy changes after the crash of 1929 that had dire effects on economic output.

First off, one can look at the Dust Bowl as causing major problems. It caused economic activity in hundreds of thousands of square miles of farmland to wither and die for years, hurting our food supply, and bankrupting many farmers. A Wikipedia search, or any study of the Dust Bowl will give pretty clear-cut answers on why it happened - over-farming. So if over-farming was the cause, why was there an accute problem in the 30's which caused the Dust Bowl?

There is a pretty straight forward answer to that. Americans were given land by the government to farm there. It was called the Enlarged Homestead Act of 1909, which gave anyone that wanted it, 320 acres of land, if they would settle it and use it for farmland. As this program built up unsustainable land, ground was stripped of its grassland, and replaced with dirt farms, which changed the ecology of the area...Ensuring that if there was to be a drought (which was in 1930), that it would be magnified due to the over-farming. This major issue can be pinned on government intervention, as they subsidized the farming in these locations - it wasn't capitalism, or a free market, it was government initiative that caused the dustbowl, as it sought to hyper-farm bad land.

Now to the next problem which also sprung up in 1930 - The Smoot-Hawley Tariff Act of 1930. It was the 2nd heaviest tariff in American history. A protectionist program which was put into place by Hoover, and signed into law....Guess when? May 1930. The same month that the DJIA dropped again, never to recover.

Looking at Wikipedia, you can see what the act did:

- Imports dropped by 66% between 1929 and 1933 (due to retaliation from many countries abroad)

- Exports dropped by 61% between 1929 and 1933

- Some economists argue that the act actually helped cause the crash of 1929

Now, thats not to say that Smoot-Hawley caused the depression in and of itself, either. But it was (again) a government intervention into the free market, which, overall, casused major problems to help take America into the depression even further. The tariff was repealed in 1944-1945 due to the need of many imports to Europe after WW2, which caused America's huge jump into a superpower. So we can see in a 10 year span, a pretty strong correlation between problems of government tariffs, and problems, as well as their repeal and benefit for America.

So again, I have to ask: where were the grandoise reduction of regulations, and pro-capitalist changes that caused the economy to contract so severely? What I see from all the research I've done is that government intervention during the dust bowl, and government intervention in international trade helped exacerbate the problem, making it far worse than it was.

There are many other views on other aspects of the depression - there is indeed the Keynesian theory that the government spent a lot, and it helped recover the economy. However, in Keynes' view, there wasn't enough done, especially in the area of farm subisdies to get the economy back to pre-depression levels. My contention is that had the government not of meddled in environmental affairs by subsidizing the land, you would not of needed to subsidize the farms during FDR's term, either...Keynes puts the cart before the ox on that. Furthermore, the problem wasn't solved until WW2, which put everyone to work and also set America up for being able to pay off the debts. The problem with Kenyesian economics is that it always assumes that there will be a recovery that will magically allow us to pay off everything, and go on our merry way. Yet we're seeing now that some countries took on Keynes view that the government should spend a lot during bad times, yet doesn't have a recovery, and has to default, or go through a double-dip recession, because the underlying problems were never fixed.

Hopefully that explains my view and understanding of the Great Depression. Although that we can probably agree that spending money got us out of the depression (due to WW2) fixed the depression, the cause was intrisically tied to government meddling in the free enterprise system. Yes, the greedy banks may have caused problems that started the depression due to poor bank practices, but had the government not meddled (through Smoot-Hawley, Hoover's 60% tax rate on the rich, the Enhanced Homestead Act, and so on), it would have simply been a recession like we have had many other times since instead of the worst economic decade of our country's history.

Here are a few YT videos on the Great Depression by my favorite economist, Milton Friedman:

Hope this helps explain some of the reasons why government interventionism is not a good thing - both for wars, social mores, and economics.

Back from the dead, I'm afraid.