Timmah! said:

Final-Fan said:

This article states that one of the ways to reduce a trade deficit (and the most pleasant from what I recall) is to reduce the budget deficit. Bush has presided over the most outrageous and needless budget deficit since the early days of Reagan's presidency -- largely as a result of his tax cuts, which are widely credited with prolonging the recession of the early 2000s. So yes, Bush has negatively affected the economy (along with the Republican party overall; I agree that he - and even his administration - couldn't significantly damage the economy singlehandedly).

By the way, the economy and stock market are recovering nicely when you look at the numbers, but what about looking at wages? It might not be a "jobless recovery", any more, but the working man has not enjoyed a comparable increase in real wages AFAIK, and I have done a little poking around on this subject. |

Tax cuts cannot prolong a recession!! It's impossible. The tax cuts helped pull us OUT of the recession, 9/11 is what exacerbated and prolonged the recession. People forget what happened so easily. Explain to me how more money in the pockets of the American people can possibly be bad for the economy let alone PROLONG a recession, it just makes no sense at all and has absolutely no logical basis in ecenomics. I never said anything about Bush's spending policies. For one, spending policy is largely the fault of congress, but Bush is also at fault for not vetoing the exorbatent spending of the past years. I strongly disagree with congress and the president on the spending policies that they together have created. I think that tax cuts along with spending cuts are what is in the best interest of the nation. The budget deficit is not a result of the tax cuts, in fact the budget deficit has gotten smaller ( http://www.reuters.com/article/topNews/idUSWBT00724820070711) because the federal tax revenue has INCREASED significantly after the tax cuts (this is due to a stronger economy causing money to change hands more often, a proven side effect of tax cuts. More money is moving around the economy, thus more taxes are collected even at the lower rate) http://www.cbo.gov/ftpdocs/81xx/doc8116/05-18-TaxRevenues.pdf. This is IN SPITE of the out of control spending. The budget deficit is due only to out of control spending in Washington, I blame that on both congress and the president. They are both culpable in this issue. You fail to realize, however, that the budget deficit has decreased in recent years due to the increase in revenues after the tax cuts. Thus your blaming the budget deficit on tax cuts just doesn't make sense. Also, wages have been rising at a pace faster than inflation since 2006, something that hasn't happened for a while. http://www.csmonitor.com/2006/1120/p01s03-usec.html Pretty much all of your statements about taxes, wages, deficit, etc are not true. This is an example of mis-information propogeted by a habitually negative media. Negative media = scared people = more viewers = more ad revenues for the news stations. |

A. Taxes and Spending

1. When Bush was campaigning, and the economy was good and we had a budget surplus, he said, 'Tax cuts are what the economy needs right now.'

When Bush was President, and the economy was bad and we had a huge budget deficit, he said, 'Tax cuts are what the economy needs right now.'

When Bush was President, and the economy was recovering but we still had a huge budget deficit, he said, 'Tax cuts are what the economy needs right now.'

When a man's answer to every concievable economic situation is "MOAR TACKS CUTS" I know that that man is wrong.

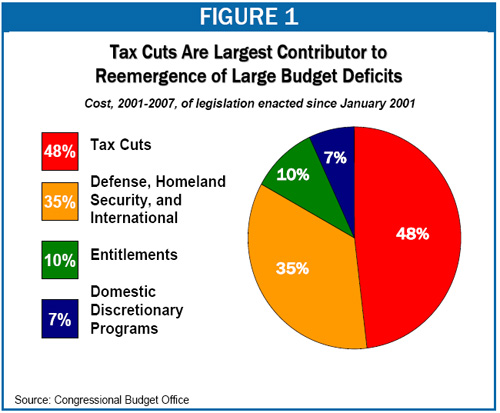

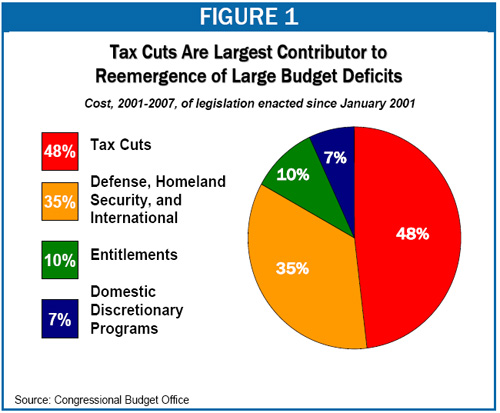

2. The primary result of tax cuts is decreased tax revenue. This is a tautology, but it seems to be one that you do not grasp. Maybe this will help:

"...when Treasury Department staff simulated the economic effects of extending the President’s tax cuts, they found that, at best, the tax cuts would have modest positive effects on the economy; these economic gains would pay for at most 10 percent of the tax cuts’ total cost." (emphasis in original)

http://www.cbpp.org/9-27-06tax.htm

| Total Real Per-Capita Revenue Growth in 22 Quarters after the Last Business Cycle Peak |

| Current Business Cycle | -0.4% |

| Average for All Previous Post-World War II Business Cycles | 9.8% |

| 1990s Business Cycle (Following Tax Increases) | 10.7% |

"Even taking into account the growth in revenues in fiscal year 2006, total revenue growth over the current business cycle as a whole has still been negative, after adjusting for inflation and population growth. (The current business cycle began in March 2001, when the last business cycle hit its peak and thereby came to an end.) In other words, the current revenue “surge” is merely restoring revenues to where they were half a decade ago." (emphasis in original)

3. From your own Reuters link: "He has increased spending by nearly 50 percent since taking office, while at the same time repeatedly cutting taxes primarily on the wealthiest," Conrad said. "Debt has exploded on his watch -- rising from $5.8 trillion in 2001 to approximately $9 trillion by the end of this year."

Doubtless the tax base has grown since the tax cuts went into place. But even supposing that much of that tax base increase is due to tax cuts -- a view that historical data largely fails to support (see above link) -- how many decades would it take for that increased tax base to erase the massive THREE TRILLION FUCKING DOLLAR DEBT AND GROWING that accumulated due to its creation?

4. I may have been wrong to say that the tax cuts prolonged the recession; after all, the link I cited says that "In the short run, well-designed tax cuts can help to boost an economy that is in a recession. In the longer run, well-designed tax cuts can have a modest positive impact if they are fully paid for." The problem, of course, is that Bush's tax cuts were not paid for AT ALL and the quality of their design is subject to much criticism. And tax INCREASES don't seem to hurt the economy much, either:

B. Wages

Granting that real wages have gone up since 2006, that means that they did not go up (i.e. went DOWN) from 2001-2006. The recession ended in, what, 2002 or 2003? It sounds like the working man got screwed compared to the Dow Jones (and therefore big business). I bet it still hasn't broken even for the period between when the recession ended and now. http://www.nytimes.com/2006/08/28/business/28wages.html

Pretty much all of your statements about taxes, wages, deficit, etc are not true. This is an example of ... well, I don't know what, because I'm not psychic, nor do I pretend to be. But it does smack of neoconservative tunnel vision.

; - ) : - ) : - ( : - P : - D : - # ( c ) ( k ) ( y ) If anyone knows the shortcut for

; - ) : - ) : - ( : - P : - D : - # ( c ) ( k ) ( y ) If anyone knows the shortcut for