NJ5 said:

Avinash_Tyagi said:

NJ5 said:

I do understand, we keep coming back to the same point, which is:

So your point is that all the consumption money comes from the government, and people are still as indebted as before. What happens when Uncle Sam's tap gets turned off? People's problems are still as big as before, and the government and taxpayers are poorer.

|

Tjhe problem is you're making flawed assumptions there, first the liklihood that the US's tap will be shut down any time soon is remote at most, no the US is still the most important single market in the world and will be for the next decade or so, so that won't happen, secondly that people will still be as poor and indebted, consumption is down because people aren't spending as much, meaning they are becoming less indebted. They are still spending, just not as much, that reduced spending is going into their debts and savings, meanwhile government is working to stimulate production and employment and eventually consumption.

As for the Stimulus plan chart, even the most optimistic economists were saying that that chart was too rosy when it was released NJ5, its called spin.

|

1- By tap I meant the stimulus funds. How long do you think the USA will have to spend hundreds of billions in stimulus and double its annual deficit?

2- If you saw the data in the last link of the OP, consumer debt decreased by 2.36% in 9 months. This means consumers are very slowly reducing their debt.

3- If you accept that the unemployment charts were spin, how can you still accept the White House's statement that the recession will be over this year or early next year?

|

Who said I was accepting their spin? I have my own reasons to believe that the recession will end by the middle of next year.

Maybe its because they don't feel their debt is as crushing as your source seems to believe, if it was, they would be deeper retractions.

US can keep deficit spending for quite some time, so its not really a concern in the short run, after the recession is over it will need to be addressed, but not right now.

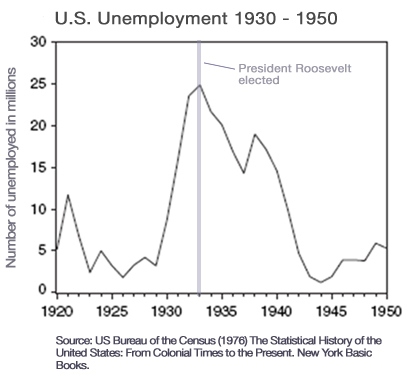

Didn't I just get finished saying the war was its own bubble? It was government propped up employment, it wasn't economic market based. Sure, it looks good on paper but we still were not out of the woods yet.

Not its not that the war was a bubble, it was thatthere was a period of transition from the war economy to the post war economy, which caused a small postwar recession, however even accepting the recession after the war, the depression was over during the War

One factor that many people seem to be missing is how the continuing rise in the unemployment rate will cascade through the system and (potentially) create new shocks to the system on the whole.

If we're looking at 11% or 12% unemployment at the end of the year the banks that passed the "Stress Test" under the assumption of 8% unemployment will (potentially) be facing failure again, house prices will continue to fall as mortgages are foreclosed on whem people enter bankruptcy, and companies will be forced to scale back on their work force further because families with reduced income are going to dramatically reduce their spending.

That assumes that the banks won't be able to survive the 10-12% unemployment, and that the 10-12% unemployment will alter the number of foreclosures and bankrupticies and spending dramatically over where it is now, and likely a 1-3% increase in unemployment over our current state will not have a drmamatic effect on the economy