TheRealMafoo said:

akuma587 said:

This guy states it very well. It really does help when you use actual numbers rather than cherry pick one or two, which some of you seem to prefer.

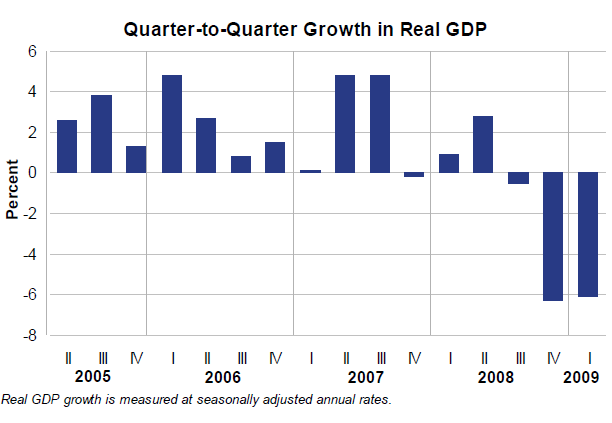

We are experiencing the deepest and swiftest recession in the U.S. since the Great Depression of the 1930s. It is definitive.

|

The first line is funny coming from you, when every time there is an economy thread about how bad it is, you come in with "The market is doing well, so things are better then it looks".

As for the second, the deepest and swiftest recession in the US was in 1921, and it was followed by the quickest recovery in history. All with the government doing nothing.

Why is every problem one that government should fix. People keep forgetting that if government had stayed out of the housing market in 1992, we would not be here today. Not only has government done nothing right to get us out of this mess, they put us here in the first place.

|

Relative to the size of the actual problem and how bad it could have been, the market IS doing well.

You are assuming all recessions are equal in terms of their causes and effects. Recessions where the banking and housing sectors are hardest hit tend to cause the most systematic problems. That is because these things are tied to so many different fundamentals in the economy. We had both of those things happen. Without any government intervention, it would have been a surefire way to get another depression. TARP was just about the best idea the Bush Administration ever had. I applaud Bush and Cheney for having the foresight to avoid being another Herbert Hoover.

And if you honestly think that if the Republicans were in power that they would sit back and let the market sort itself out on its own, you are fooling yourself and do not understand the political process in this country. They may have tried to solve the problem in a different way (via tax cuts most likely), but deficits would have been just as high, and potentially higher by foregoing so much tax revenue.

You also place to much blame on a cause simply because the word government is attached to it. Its really easy for something to have been a cause of a problem. Hell, if it wasn't for the Declaration of Independence and the Constitution none of this would have ever happened. But the important thing is determining the LEAST REMOTE cause for a phenomenon, such as the wholesale securitization of the mortgage market and lenders making loans that they actually knew were bad because they could resell them. If you want to blame the Fed for not regulating those, its totally fair, but its simply intellectual dishonesty to claim that the banks weren't the culpable parties here.

We had two bags of grass, seventy-five pellets of mescaline, five sheets of high-powered blotter acid, a salt shaker half full of cocaine, a whole galaxy of multi-colored uppers, downers, screamers, laughers…Also a quart of tequila, a quart of rum, a case of beer, a pint of raw ether and two dozen amyls. The only thing that really worried me was the ether. There is nothing in the world more helpless and irresponsible and depraved than a man in the depths of an ether binge. –Raoul Duke

It is hard to shed anything but crocodile tears over White House speechwriter Patrick Buchanan's tragic analysis of the Nixon debacle. "It's like Sisyphus," he said. "We rolled the rock all the way up the mountain...and it rolled right back down on us...." Neither Sisyphus nor the commander of the Light Brigade nor Pat Buchanan had the time or any real inclination to question what they were doing...a martyr, to the bitter end, to a "flawed" cause and a narrow, atavistic concept of conservative politics that has done more damage to itself and the country in less than six years than its liberal enemies could have done in two or three decades. -Hunter S. Thompson