rocketpig said:

mrstickball said:

Whats funny is that they show the effective tax rate for the super-rich, but never state how much they actually pay in taxes by comparison to any other group.

Of course, God forbid they show anything to be balanced. They pick and chose what charts to show so they could argue that we need to soak the rich more, rather than provide a balanced analysis about both incomes and taxes.

Where's the chart that shows the top 1% paying a majority of income taxes?

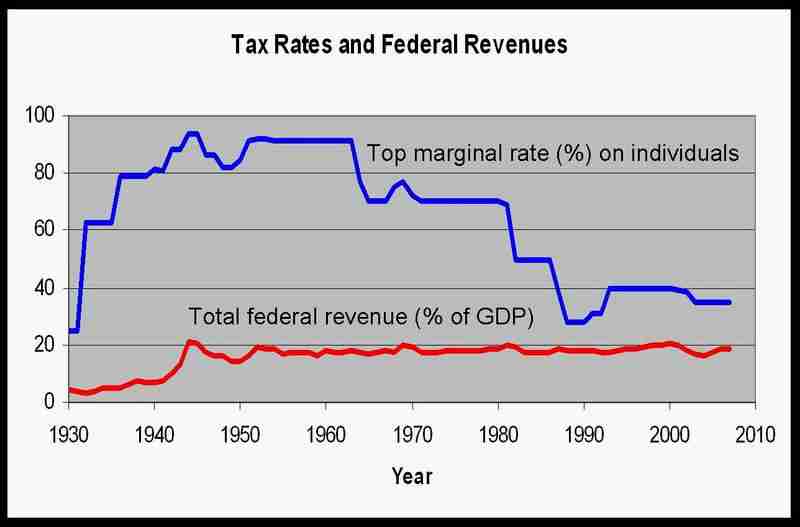

Where's the chart that shows that the Regan and Bush tax cuts forced the rich to pay a higher percentage taxes to the government that before the cuts?

The only thing that chart told me was that payroll taxes are crazy in America, and need destroyed. They are why your average family is getting killed. Funny, they don't mention anything about payroll taxes, despite they have increased 4-fold since the 50s.

|

Stickball, while the rich pay more in taxes, they're making FAR more money overall so they're still gaining ground (not to mention that their tax percentage is a little over half what it was 50 years ago). Who cares what total amount the rich are paying when it's obvious that they're the ones benefitting from slackening tax rates for the top few percent since the 50s? Look at those percentage charts. The top two are steadily increasing (with the top being nauseously so) while the "average American" is barely treading water or, in most cases, heading in reverse.

Trickle down economics was a farce that hoodwinked the American public into believing in a system that has been outright screwing them for 25 years. While few use the phrase itself anymore, it's obvious that the political system is still in place that upholds this ridiculous notion.

While Mother Jones likes to pick on Reagan and Bush about this, Clinton and Obama haven't exactly been pillars of the average American worker, either. No matter who is in power, the middle class continues to get screwed by the super-rich and their ability to control politicians, not to mention the politicians themselves, who are often in the super-rich category.

|

So then, the obvious and only answer is higher taxes on the wealthy, right?

That is my problem with the article. It only throws a few ideas around about how the rich are getting richer, and how they are ripping off the average person. The only way to fix this, from what I can gather in the article provides, is taxation.

So I must ask you: Is taxation the only way to solve our problems? Personally, I don't believe that re-distributing incomes and wealth is going to make America any better. Our real problem has to do with economic mobility - going from poverty or middle class to upper class. We see that jobs typically correlate with the degree of education one has - not just degrees, but the general quotient of the populace. Furthermore, if you look at the increasing living standards of the recently-developed countries, you don't find that their ascention was due to taxing the rich, but through providing a system to where people could achieve financial results for themselves through fair regulations, a good education system, and a tax system that wasn't burdensome. For example, look at Chile and South Korea - both have come out of 2nd-world economic wastes into great economies in a matter of just a few decades.

Education, I fear, is where America, quite franky, sucks. And a larger tax burden does litterally nothing to fix that. Our problems lie more with the problems of our education system, and how we raise Americans, than it does with how much we tax people. The rest of the world is getting smarter, while we have stagnated for decades now. That results in an uneducated, lazy, populace that can do no better than menial jobs, with lower productivity.