Kasz216 said:

Akvod said:

Kasz216 said:

Akvod said:

Kasz216 said:

Neo-Keynsian economics are still behind the curve and just about as dead as Classical Keynesian economics.

Most Neo-Keynsian's have backtraked even further that Neo-Classical economists were right on everything but Macroeconomists.

|

...?

All three are Macroeconomic views... typo on the last sentence?

Neo-Classicals try to rationalize the Classical view by saying that people are perfectly rational, and are aware of everything the government does. So any discretionary policy will backfire, because they will simply raise their expectation of inflation.

... although I asked the professor in lecture why those people didn't simply adjust their expectations to the equilibrium beforehand... but he said that a more complex explanation will be something irrational like stock markets... but it sounds pretty crappy to me.

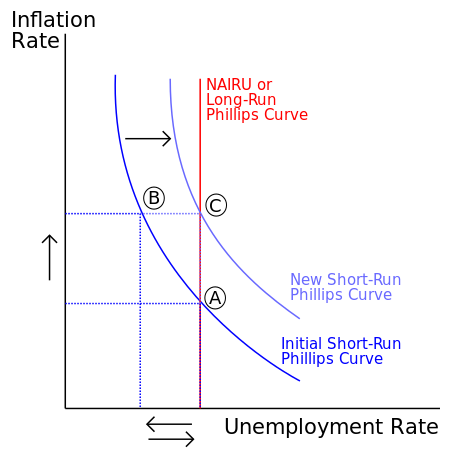

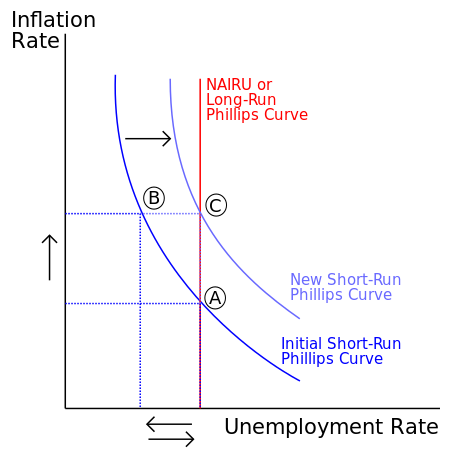

For reference.

So Neo-Classicalists are saying that if there was point A', which is A moved rightward (low inflation, and high unemployment), raising the inflation rate (moving the point back to A), will only result in a shift to C' (C, moved rightwards so that it has the same unemployment level).

The question is... why didn't those oh so rational people move their expectation so that the curve will shift down, and result in lower inflation and natural unemployment rates?

|

No. All 3 aren't purley Macroeconomic views. They are economic theories in general. For both Macro and Micro economics. After WW2 the Macroeconomic views were absorbed with Neoclassical views.

Largely the Macreoeconomist views of Keynsians are never widely accepted because they have no microeconomic basis.

Neo-Classical Syntehsis tried to happen to provide Keynsian economics with that base.

Additionally New Keynsian economics have tried to provide a microeconomic base actually using congruent theories.

You really need to define what kind of Keynesian you are... for what it's worth... New Keynesian's would actually disagree with you. So I hope it's not them.

|

Microeconomics are concerend with the economics of ONE good or at most, industry.

Ceteris paribus, when you have a supply and demand curve of apples, and increase the price of apples, you keep the price of oranges the same.

Aggregate supply and demand curve of macroeconomists, increase the AGGREGATE price level. They look at the AGGREGATE economy. The entire thing. It's not at all microeconomics.

Dude, GEORGE W. FUCKING BUSH, engaged in Keyensian economics *bangs head*

You know? That huge ass stimulus package. Oh, no, Bush is obviously a "liberal".

I mean, for christ sakes, lowering the tax to increase spending itself is a Keyensian belief.

I believe in:

Stick Wages

MPC

... dunno, don't need anymore than that.

|

Like I said. Keynsian economics are the poltics of Laymans and Politcians. GWB is a politician. Also a Neo Conservative.

New Keynesians also believe in Sticky Wages... and in MPC... and they saw the stimulus as a HUGE mistake.

What you are missing is the sticky wages... even by Keynesian definition are EXTREMELY short term... and that Neo Classical economists are right in the long term.

Therefore it is wrong under the New Keynsian model to spend large chunks of money to get the economy going... instead they should simply engage in moderate monetary policy to ride out the storm.

Most Keynesian's don't even believe in Keynesian like spending anymore.

|

Right... moderate monetary policy... well at least that's better than Hoover, who fucking engaged in contractionary monetary policy.

And yeah, I guess some extremist minority economists are being hired by both Republicans and Democrats...

In the long run, we're fucking dead.

I mean, c'mon. MODERATE monetary policy? We are NEAR ZERO. That's BEYOND moderate. And did you think that was enough? The whole point about Keynesianism is so that we get the economy back to its long run QUICKER, SHORTER.

If businesses are forced to liquidate their assets, then that reduces our capacity to produce more things in the long run. If people are forced to fucking lose their homes (Cramer) then that hurts us in the long run.

If we can engage in defeceit spending NOW, then we get back the economy QUICKER, and then we don't have to fucking deal with years of shit.

Yes, Hoover didn't properly use monetary policy, but again, look at now, we had to use BOTH monetary and fiscal policy to get our economy back out of the recession, barely. A Republican president, WHO COULD NOT LOOK FORWARD TO REELECTION (throwing the fucking politics theory out the window), engaged in it. A democrat president engaged in it.

In short, Keyensianism isn't political.

Tax cuts, shout the republicans. That's Keynesian. Stimuluses, that's Keynesian.

Am I saying build bridges for every minor recession? No. Engage in monetary policy first.

But if THAT fails, THEN we engage in fiscal.