sc94597 said:

I welcome the fiscal cliff. It will do what our congress and president refuse to do - reduce spending. |

America's problem isn't actually the amount that government spends. This is what annoys me about the American conversation about this issue - everyone seems to agree that spending needs to be reduced.

America's federal budget for 2011 was US$3.8 trillion, with US$3.63 trillion actually enacted. America's nominal GDP in 2011 was almost exactly US$15 trillion. Therefore, spending (actually enacted) was 24.2% of GDP. Sounds like a lot, right?

Australia's federal budget (expenditures) for 2011 was AU$365.8 billion. Australia's GDP in 2011 was roughly $1.5 trillion. Which means that Australia's spending was 24.4% of GDP. As a percentage of GDP, Australia spent slightly more.

But that's not all. Australia has roughly one fifteenth the population of the US. Per capita, America spent US$12,062. Australia spent AU$16,006 - note that the Australian and American dollars are at about parity.

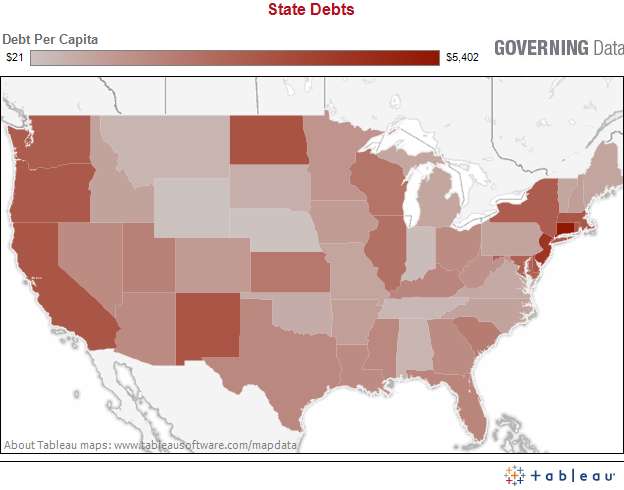

Now for the real point - Australia's budget deficit in 2011 was just AU$20.3 billion, or just over 5.5% of total expenditure. America's budget deficit was US$1.56 trillion, or nearly 43% of total spending. That's right - almost 43% of America's government spending in 2011 wasn't paid for through taxes, but by borrowing money from other countries.

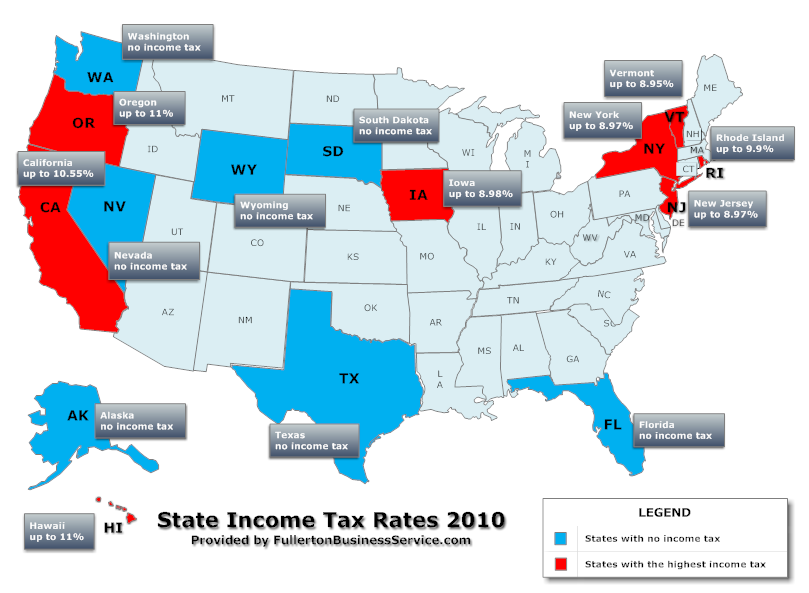

Why is it that Australia can spend more per capita and a similar amount as a percentage of GDP, and have a much smaller deficit? Because Australia's tax rates aren't absurdly low. Our top income tax rate, paid by those earning over $180,000 a year, is 45%. In America, it's 35%, and that rate doesn't kick in until $388,350 a year (it's 33% between $178,650 and $388,350).

Note that Australia's income tax is also more generous for the poor. America's tax system has a 10% tax rate for those earning up to $8700. Australia's has 0% tax rate up to $18,200. And yes, I'm fully aware of income tax credits - an absurd system that demonstrates just how badly screwed up the US tax system is.

Australia's company tax rate is a flat 30%. In the US, the corporate tax rate varies, starting at just 15%, and increasing to up to 35%. Australia's capital gains are included as part of income tax - that is, it's not taxed separately, whereas in the US it is taxed separately, at a lower rate than income tax. Furthermore, Australia's payroll tax does not only apply up to a certain amount of a person's income (in the US, it is only paid on the first $106,800.

Australia also has a national sales tax, called the Goods and Services Tax, at a flat 10% (it used to be more progressive, but John Howard decided to implement the GST for some reason) - in most US states, state sales tax is below 10%.

Of course, all of this would be irrelevant if Australia's greater relative taxation meant a weaker economy. But Australia's got a higher per capita nominal GDP than the US.

Part of America's problem, though, is BAD spending. It's wasteful in how it spends money. This results in less economic impact of government spending. What do I mean by "economic impact"? I'm referring to the effect of government spending on the economy itself. Well-targetted government spending can have a net positive impact on the budget by boosting the economy so strongly that tax revenues increase as a result. Other government spending can have near-zero impact on the economy - this is often true of so-called pork-barrel spending (that isn't to say it's true of all such spending).

Also note that economic impact isn't the only measure of good spending. Money that has no economic impact is often necessary for improving the country nonetheless.

It speaks volumes that the Department of Defense alone is 19% of US federal spending. Australia spends just 6% of total spending on all of defense. And Australia doesn't have state armed forces, either.